Baobab Raises $13.7M Series A to Revolutionize Cyber Protection for SMEs

June 18, 2025

byFenoms Startup Research

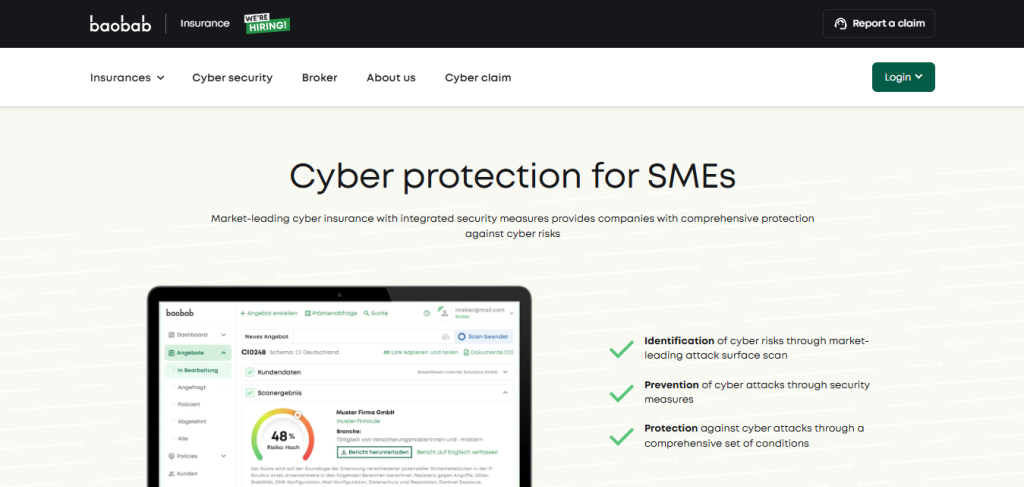

Baobab Raises $13.7M Series A to Revolutionize Cyber Protection for SMEs

In a significant milestone for cybersecurity in the SME (Small and Medium Enterprise) space, Baobab, a fast-growing cybersecurity startup, has successfully raised $13.7 million in Series A funding. The round was led by a powerhouse consortium of investors including Viola FinTech, eCapital Corp., Augmentum Fintech, and several others. This investment marks a pivotal moment in Baobab’s mission to provide comprehensive cyber protection for small and medium-sized businesses, a sector often underserved in terms of digital defense.

The Rising Demand for SME Cyber Protection

As cyber threats grow more complex, SMEs are increasingly vulnerable to phishing, ransomware, and data breaches. Many lack the resources or technical expertise to implement effective security measures. Baobab addresses this gap with its AI-driven, all-in-one cybersecurity platform tailored specifically for the needs and constraints of SMEs.

The startup’s platform provides:

- Identification of cyber risks through machine learning

- Prevention of threats via automated security actions

- Rapid detection and mitigation of attacks

- Insurance integration for comprehensive post-breach protection

This holistic approach not only protects businesses from financial and reputational damage but also offers peace of mind in an era of rising digital risk.

Who’s Behind the Round?

The Series A round brings together a dynamic group of investors committed to digital innovation:

- Viola FinTech – A leading global fintech fund known for backing scalable, data-driven ventures.

- eCapital Corp. – A prominent venture capital firm investing in B2B tech startups.

- Augmentum Fintech – A top-tier European fintech investor.

- Project A Ventures, Christof Mascher, and others also participated, signaling strong belief in Baobab’s business model and leadership.

Meet the Founders: Vincenz Klemm and Anton Foth

The brains behind Baobab are Vincenz Klemm and Anton Foth, seasoned entrepreneurs with deep expertise in cybersecurity and risk management. Their vision is rooted in simplifying and democratizing cyber protection - bringing enterprise-grade defense to businesses of all sizes.

Their leadership has been instrumental in Baobab’s rapid growth and in forging strong partnerships with insurance providers, regulators, and broker networks.

Why Baobab Is a Game-Changer

Baobab is not just another cybersecurity tool - it's a full cyber risk management ecosystem. What sets it apart?

- SME-Focused: Unlike traditional solutions built for large enterprises, Baobab understands the unique challenges SMEs face.

- Plug-and-Play Simplicity: The platform is easy to deploy, requiring minimal technical setup.

- End-to-End Coverage: From risk detection to breach recovery, Baobab offers an integrated response.

This is especially relevant given the staggering growth in cyber threats. According to IBM’s Cost of a Data Breach Report 2024, the average cost of a data breach globally is $4.45 million, with small and medium-sized enterprises (SMEs) often the least prepared. In fact, 43% of all cyberattacks now target SMEs, yet only 14% of them are equipped to defend themselves, per Accenture’s Cybercrime Study.

And that’s just one side of the equation. The cyber insurance market is projected to grow from $13.33 billion in 2023 to over $84 billion by 2030, according to Fortune Business Insights. With increased regulatory pressure and more stringent underwriting standards, insurers are now demanding proactive cyber hygiene from policyholders - creating an urgent need for solutions like Baobab.

The company has made strategic inroads into this space, building tools that allow brokers to actively monitor and manage client risk profiles. This dual functionality - serving both SMEs and insurance brokers - creates a powerful network effect. Brokers aren’t just resellers; they become ongoing distribution partners, each bringing dozens or hundreds of businesses into Baobab’s ecosystem.

And here lies a deeper insight: Baobab isn’t just selling cybersecurity - it’s monetizing trust. By embedding their platform into insurance workflows, they’re aligning with regulatory and compliance pressures that insurance companies and their clients already face. This positioning moves them from being a line-item security vendor to being an integral part of risk underwriting and mitigation. That kind of embedded value creates staying power, and more importantly, defensibility.

Founders paying attention will notice the elegance of this model. Baobab isn’t fighting for direct-to-SME acquisition channel by channel - they’re harnessing the distribution power of an adjacent industry (insurance) with an aligned incentive structure. Each broker becomes a multiplier. Each policy written with Baobab as the embedded cybersecurity solution deepens the moat.

This is the kind of strategic positioning that unlocks exponential B2B growth - not just product-market fit, but product–market–distribution fit. It’s how a cybersecurity platform becomes infrastructure.

Strategic Plans for Growth

With this new capital infusion, Baobab plans to:

- Expand its R&D and engineering teams

- Deepen integration with insurance ecosystems

- Scale operations across Europe and North America

- Launch new AI-powered features to enhance threat prediction and prevention

As SMEs worldwide continue to digitize their operations, Baobab aims to be the trusted shield for their digital assets.

A Strong Signal to the Cybersecurity Market

This Series A round is more than just funding - it's validation. In a world where cybercrime damages are projected to hit $10.5 trillion annually by 2025, Baobab is positioning itself at the forefront of the SME cybersecurity wave.

Investors, customers, and analysts alike are watching closely as Baobab scales its operations. With solid funding, a clear market need, and a seasoned team, the startup is poised to redefine what cyber protection looks like for small and mid-sized businesses.

Final Thoughts: A Safer Future for SMEs

Baobab’s mission to empower SMEs with cutting-edge cyber protection just got a major boost. This $13.7 million Series A round will not only fuel technological advancements but also expand the company’s ability to protect thousands of businesses from digital threats.

In a landscape where one breach can destroy a company overnight, Baobab's platform is not just a product - it’s a lifeline for SMEs navigating today’s digital battlefield.

Stay Updated

To learn more about Baobab and its innovative cyber protection solutions, visit Baobab's website or check out the full funding announcement here.