TrustCloud Raises $15M to Make Compliance the Backbone of Startup Growth

July 10, 2025

byFenoms Startup Research

TrustCloud, a fast-growing governance, risk, and compliance (GRC) automation platform, has secured $15 million in funding to scale its mission of making trust as easy to operationalize as code. The round was led by ServiceNow Ventures, with participation from Cisco Investments, Presidio Ventures, OpenView Venture Partners, Tola Capital, and other existing investors.

Founded by Sravish Sridhar, TrustCloud is redefining how companies - especially startups and scaleups - approach security compliance, privacy standards, and risk governance. At a time when data trustworthiness is as critical as product-market fit, the company is offering a frictionless path to pass audits, maintain certifications, and prove continuous security alignment.

What TrustCloud Solves

Traditionally, compliance and risk programs have been plagued by siloed tools, manual processes, and endless spreadsheet audits. This not only slows down engineering and security teams but also diverts precious resources from product development and go-to-market efforts.

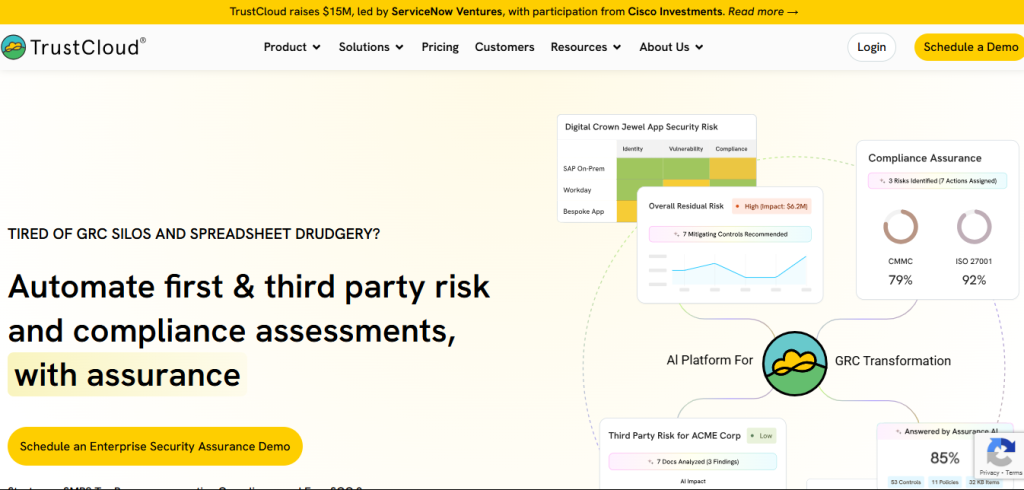

TrustCloud turns this pain into progress. The platform connects directly with a company’s tech stack - across cloud infrastructure, task management, version control, HR systems, and more - to continuously monitor compliance against frameworks like SOC 2, ISO 27001, HIPAA, and GDPR.

But it goes deeper than certifications. TrustCloud provides real-time risk posture, maps tasks to controls, automates evidence collection, and even flags potential compliance violations before they become audit problems. It’s security-as-operating-system rather than security-as-afterthought.

Why This Matters Right Now

GRC is no longer a function companies can delay. In sectors like fintech, healthtech, SaaS, and AI, trust is the cost of doing business. Investors, enterprise buyers, and regulators increasingly demand visible, defensible compliance from day one.

A 2023 study by PwC showed that 72% of B2B startups now undergo third-party risk assessments before closing mid-market or enterprise deals - and failing those audits can be a dealbreaker. Meanwhile, CB Insights reports that startups that adopt compliance tooling early grow revenue 1.5x faster due to smoother sales cycles and fewer procurement delays.

This is where startup founders often underestimate the strategic upside of early compliance readiness. The trap is assuming that GRC slows velocity when in reality, it accelerates it - if done right. Founders who build compliance into their product infrastructure rather than treating it as a legal hurdle not only pass audits but also turn trust into a sales asset. By making proof of security and compliance part of the pitch deck, these companies remove friction from every deal and win faster. In competitive markets, trust isn’t just protective - it’s offensive. And TrustCloud enables that transformation.

The Strategy Behind TrustCloud’s Momentum

TrustCloud’s product philosophy centers on three key pillars:

- Automate to Accelerate: Compliance workflows are powered by real-time integrations, drastically reducing time spent preparing for audits.

- Make Risk Actionable: The platform visualizes threats and gaps in an intuitive dashboard, helping teams prioritize remediation by business impact.

- Embed Trust into Growth: Rather than a blocker, GRC becomes a growth enabler - supporting faster procurement, better partnerships, and stronger investor confidence.

This positioning gives TrustCloud a significant edge in a fragmented GRC market, where legacy players often focus on enterprise risk but ignore the speed and agility modern startups demand.

Founders’ Insight: Turning a Cost Center into a Competitive Edge

Too many early-stage founders treat compliance as a box to check when funding or enterprise deals are on the line. But TrustCloud is helping them realize a fundamental shift: compliance done well becomes a strategic asset, not just a legal safeguard.

Founders who bake GRC into their GTM motion can speed up procurement, reduce churn, and eliminate trust objections during sales. This reframing - from defense to growth lever - transforms how risk is perceived across the C-suite. Instead of draining time, it drives revenue.

Industry Outlook: The GRC Market Is on a Growth Surge

The global GRC software market is experiencing robust growth, fueled by stricter data privacy laws, escalating cyber threats, and the digitalization of business operations. According to MarketsandMarkets, the GRC software industry is expected to grow from $15.2 billion in 2022 to $30.7 billion by 2027, posting a 15.1% CAGR.

Further backing this momentum, Deloitte’s 2024 Global Risk Management Survey reports that 87% of companies plan to increase spending on compliance and operational risk management tools in the next two years. In addition, 70% of cloud-native companies are actively seeking solutions that provide continuous monitoring over static point-in-time audits - driving demand for real-time platforms like TrustCloud.

Venture capital is also flowing into the space: GRC-focused startups raised over $1.6 billion in funding globally in 2023, according to Crunchbase. The modern compliance stack is evolving into a foundational business layer, akin to payments or analytics - no longer optional but mission-critical.

What’s Next for TrustCloud

With this new funding, TrustCloud plans to:

- Expand engineering and product teams to ship more integrations and customizable workflows

- Deepen AI and ML-driven insights for faster issue resolution and predictive risk monitoring

- Grow its partner ecosystem among MSSPs, auditors, and compliance advisors

- Launch vertical-specific offerings for healthcare, fintech, AI, and dev tool startups

- Accelerate GTM teams to meet surging demand from startups scaling up security operations

CEO Sravish Sridhar shared that the company will also double down on community education - empowering non-security founders and ops teams to understand compliance as part of core business operations.