Riva Money Secures $3M Pre-Seed Funding to Reinvent Global Payments

August 22, 2025

byFenoms Start-Ups

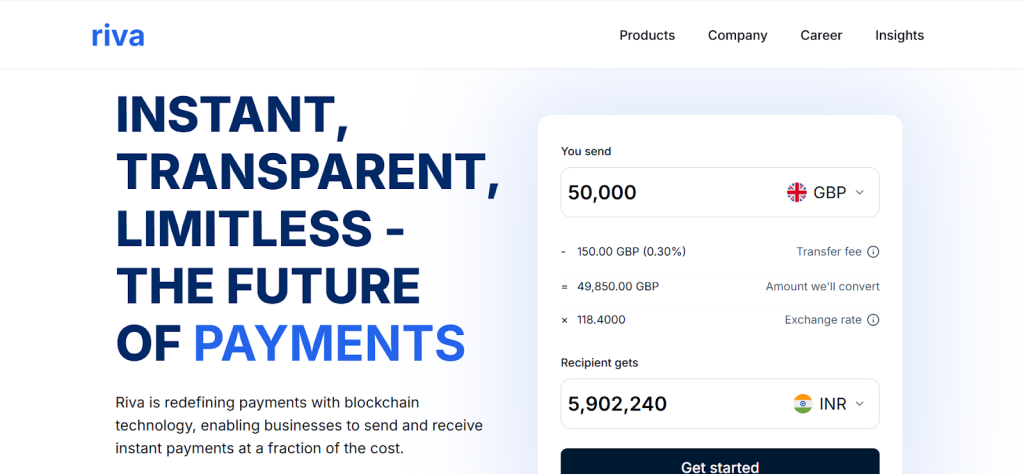

Riva Money has raised $3 million in Pre-Seed funding, a powerful step toward reshaping how individuals and businesses move money across borders. The round was led by an impressive group of backers, including Project A, Revolut, Ebury, Monzo, and J.P. Morgan, signaling strong confidence in Riva Money’s mission to simplify and streamline international payments.

Founded by Niklas Höjman and Mahendra P.S. Katoch, Riva Money is setting its sights on becoming a key player in the global financial ecosystem. The funding marks more than just a milestone - it positions the company to capitalize on the growing demand for transparent, efficient, and affordable cross-border payment solutions.

Why This Raise Matters

International money movement is notoriously complex, plagued by hidden fees, delays, and inconsistent exchange rates. Legacy systems still dominate much of the market, leaving consumers and businesses frustrated with outdated processes.

Riva Money’s fresh approach seeks to cut through these inefficiencies. With the Pre-Seed funding, the company plans to:

- Expand product development, ensuring secure and seamless payments.

- Strengthen compliance infrastructure to meet global regulatory standards.

- Build partnerships with fintech players and financial institutions.

- Grow its presence in key regions where cross-border money flow is critical.

In a market where remittance flows are projected to reach $860 billion globally in 2025 (World Bank), Riva Money is aligning its mission with one of the most urgent financial needs of our time.

Backers with Real Fintech Credibility

The roster of investors backing Riva Money is not just capital - it’s deep fintech expertise. Heavyweights like Revolut and Monzo are household names in digital banking, while Ebury brings extensive experience in international trade finance. Add to that Project A’s venture expertise and J.P. Morgan’s financial muscle, and you have a powerful combination of strategic partners who can accelerate Riva’s growth trajectory.

Their involvement suggests confidence not only in Riva Money’s vision but also in its ability to execute on a global stage. For early-stage fintech startups, this caliber of backing is often as valuable as the funding itself.

Embedding Scalability from Day One

Here’s where many early-stage fintechs stumble: they focus on solving a single local problem but fail to design scalable systems from the start. What Riva Money is doing differently - and what other founders can learn from - is embedding scalability from the first line of code to compliance strategy.

Instead of treating cross-border expansion as a “later stage” challenge, Riva Money is building its infrastructure to support multiple markets and regulatory frameworks immediately. This means less retrofitting down the line and more agility in responding to new opportunities.

For founders, the takeaway here is clear: don’t just build for the market you’re in - architect for the market you’re aiming to dominate. This forward-thinking approach can save millions in re-engineering costs and accelerate time to scale.

The Fintech Landscape Riva Is Entering

The global payments sector is in the midst of massive transformation. Key drivers include:

- Digital-first adoption: Mobile-first financial services are becoming the norm, especially in emerging economies.

- Regulatory harmonization: Governments and financial bodies are working toward standards that encourage safer, faster cross-border payments.

- Consumer demand for transparency: Users expect low fees and real-time tracking of funds.

- Embedded finance: More businesses outside traditional finance are integrating payment solutions into their offerings.

According to McKinsey’s Global Payments Report, revenues from the payments industry exceeded $2.2 trillion in 2023 and are expected to grow steadily over the next decade. Within this, cross-border payments account for nearly $150 trillion annually in transaction flows - a staggering opportunity for disruption.

Market Outlook: Where Riva Money Fits In

The cross-border payments market is ripe for innovation. Despite the entrance of players like Wise and Revolut, most legacy systems still rely on intermediaries that slow down transactions and inflate costs. By focusing on scalability, compliance, and a user-friendly experience, Riva Money is positioning itself to capture market share in areas underserved by current solutions.

- Remittances to low- and middle-income countries are expected to remain resilient, with World Bank data showing a 2% growth rate annually.

- SME trade finance needs are expanding, creating opportunities for fintechs that can simplify currency exchange and invoicing.

- Real-time payments adoption is accelerating, with global volume forecasted to surpass 400 billion transactions annually by 2030 (ACI Worldwide).

For Riva Money, the opportunity lies not just in competing with existing players, but in expanding the very definition of what global money movement can look like - borderless, transparent, and embedded directly into the way people and businesses operate daily.

What’s Next for Riva Money

With fresh funding and powerhouse investors, Riva Money has the tools to take ambitious next steps. Expect to see:

- Product launches targeting high-friction corridors for payments.

- Partnerships with banks and fintech ecosystems to integrate services.

- Talent acquisition across compliance, product, and engineering.

As the company scales, it won’t just be competing in fintech - it will be helping to define the next era of global financial infrastructure.