CVector Secures $1.5M Pre-Seed to Revolutionize Supply Chain Visibility

August 23, 2025

byFenoms Start-Ups

Transforming the Future of Logistics

The global logistics and supply chain sector has been under mounting pressure. From pandemic-induced bottlenecks to geopolitical disruptions, businesses have realized that traditional supply chain systems are no longer fit to handle the unpredictability of today’s markets.

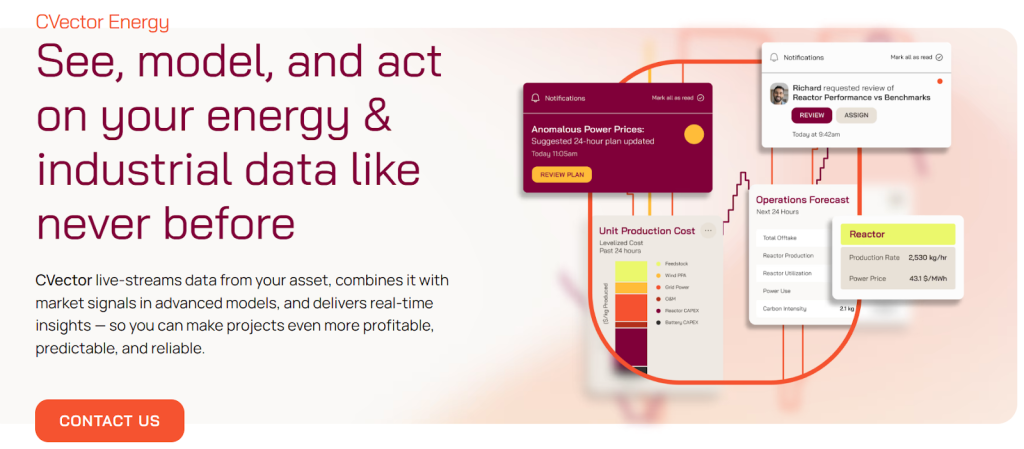

CVector enters this picture with bold ambitions. By leveraging advanced AI and data-driven insights, the startup is aiming to build a platform that makes real-time supply chain visibility not just a luxury, but the default operating mode. The $1.5M Pre-Seed investment from Schematic Ventures, a fund known for its sharp focus on supply chain and logistics innovation, sets the foundation for this ambitious journey.

Why CVector’s Vision Matters

For decades, logistics networks have been riddled with information silos. Freight forwarders, manufacturers, distributors, and retailers often operate on disconnected systems, making it nearly impossible to track goods end-to-end. This opacity leads to inefficiencies, delays, and cost overruns.

CVector’s approach is to simplify this by creating a unified intelligence layer across fragmented supply chain networks. Think of it as building the Google Maps for freight and logistics - where stakeholders can track, optimize, and predict movements with precision.

Investors are betting that this visibility is not just desirable but critical for the next era of commerce.

Strategic Backing from Schematic Ventures

The participation of Schematic Ventures is more than just a financial injection. Known for backing logistics startups like Flock Freight and Stord, Schematic brings deep industry expertise and a network that will help CVector accelerate adoption. For early-stage startups, such partnerships are often as valuable as the dollars raised.

The Subtle Art of Founder-Led Storytelling

An underappreciated skill in raising a round like this is not just proving the technology but communicating a vision that investors can rally around. Founders often focus heavily on technical achievements, but what moves pre-seed investors is clarity of problem framing.

In CVector’s case, Richard Zhang didn’t just describe logistics inefficiencies - he painted a vivid picture of how billions are lost annually to late shipments, redundant costs, and lack of predictability. This narrative alignment made the company’s vision feel not only urgent but inevitable.

Here’s something founders should take note of: investors want to fund inevitability, not possibility. If you can craft your story in a way that frames your solution as the only logical outcome of a broken system, you drastically increase your odds of raising successfully.

Building Defensibility Beyond Tech

One lesson many logistics startups miss is that technology alone doesn’t create defensibility. APIs can be copied, dashboards can be mimicked, and AI models can be retrained. The real moat comes from distribution channels and partnerships.

CVector’s early strategy seems to recognize this. Instead of trying to sell directly to hundreds of mid-sized shippers, they are reportedly building pilot integrations with key logistics partners who already manage large volumes of freight data. This not only speeds up adoption but embeds the platform deeply into existing workflows - creating switching costs and sticky usage.

Founders in other industries should pay attention to this play: distribution strategy often trumps product sophistication in early markets. You don’t always need the “best” technology, but you do need the best path to scale it.

The Bigger Picture: Global Supply Chain Tech

CVector’s $1.5M raise comes at a moment when venture interest in supply chain technology is resurging. In 2021 alone, more than $24 billion was invested globally into logistics and supply chain startups, according to PitchBook. Although funding cooled in 2022–2023 due to macro headwinds, logistics resilience is again a priority as disruptions continue to plague global trade.

AI-driven supply chain platforms, digital freight brokers, and real-time tracking solutions are emerging as hotbeds for VC activity. With a relatively lean capital requirement to build its MVP, CVector is well positioned to ride this wave of renewed focus.

Industry Outlook and Opportunity

The global supply chain management (SCM) market size was valued at $26.8 billion in 2022 and is projected to reach $62.2 billion by 2030, growing at a CAGR of 11.1% (Allied Market Research). This growth is driven by increasing globalization, heightened e-commerce demand, and the digital transformation imperative.

Investors are betting that real-time visibility platforms will be indispensable in this new era. With regulations tightening on emissions reporting and sustainability metrics, logistics players are under pressure to track not just cost and time but also environmental impact.

CVector’s vision of unifying these insights into one intuitive platform puts it at the intersection of two seismic shifts: the digitization of logistics and the sustainability accountability movement.

What This Means Going Forward

This Pre-Seed round gives CVector breathing room to scale its team, refine its platform, and validate early customer pilots. But the road ahead is challenging. Logistics is a notoriously fragmented industry, and adoption requires not just technology but deep relationship-building.

Still, the $1.5M injection provides the runway to make these bets. If CVector can execute, it stands to become a critical enabler of global commerce.

For founders watching this story unfold, the takeaway is clear: clarity of vision, defensibility through distribution, and inevitability framing in your pitch are the levers that move investors at the earliest stages.