Arthrosi Therapeutics Secures $153 Million in Series E Funding to Redefine Treatment for Gout and Inflammatory Diseases

October 16, 2025

byFenoms Start-Up Research

Arthrosi Therapeutics, Inc., a clinical-stage biopharmaceutical company pioneering next-generation therapies for inflammatory diseases, has successfully raised $153 million in Series E funding. The round was led by Prime Eight Capital Limited, with participation from CR Biotech, HighLight Capital, HM Venture Partners, ReliantTech Limited, and existing shareholders. This significant infusion of capital positions Arthrosi to accelerate its late-stage clinical programs and strengthen its path toward commercializing a novel, first-in-class treatment for gout.

Building the Next Era of Anti-Inflammatory Innovation

Founded with a mission to develop safer, more effective therapeutics for patients with chronic inflammatory conditions, Arthrosi Therapeutics is challenging the outdated approaches that have dominated gout management for decades. The company’s lead candidate, AR882, represents a breakthrough in selective uric acid inhibition - designed to provide potent efficacy while minimizing safety risks associated with conventional treatments.

As lifestyle diseases and metabolic disorders continue to rise globally, the need for safer anti-inflammatory options has become increasingly urgent. Arthrosi’s science-driven strategy addresses this need head-on by combining rigorous pharmacology with patient-centric design.

Strategic Momentum and Market Vision

With this new funding, Arthrosi will advance AR882 through pivotal Phase III trials, preparing for regulatory submissions and commercialization. The company also plans to expand its research pipeline into related indications, leveraging the same scientific framework that underpins its flagship compound.

This Series E round not only validates Arthrosi’s clinical progress but also highlights growing investor confidence in companies developing targeted small molecules. As biologics continue to dominate headlines, startups like Arthrosi are proving that precision chemistry can still deliver scalable impact - particularly in chronic diseases with large, underserved populations.

The Founder’s Vision: Precision Over Hype

At the helm is Litai Yeh, whose deep experience in pharmaceutical R&D and unwavering commitment to translational science have shaped Arthrosi’s trajectory. Yeh’s vision goes beyond treating symptoms - he aims to restore biological balance and reimagine how gout is understood at the molecular level. Under his leadership, Arthrosi has transformed from a niche clinical venture into one of the most closely watched players in metabolic inflammation.

Here’s where founders across industries should pay close attention - because what Arthrosi is doing offers a profound ultra value drop for any entrepreneur navigating complex, regulated markets. The company didn’t chase hype cycles or pivot endlessly to follow investor sentiment. Instead, it built its credibility through discipline and data. Founders often underestimate the compounding effect of scientific rigor, operational patience, and consistent signaling to the market. When you’re in a space where validation takes years, the differentiator isn’t speed - it’s clarity of conviction. Yeh and his team exemplify that principle.

This is a critical insight for any founder: while most startups optimize for momentum, the most enduring ones optimize for trust velocity - how fast they can earn, sustain, and compound credibility with key stakeholders. In biotech, that’s regulators and clinicians; in tech, it might be users or developers. But the psychology is identical: markets reward depth over noise. Arthrosi’s ascent proves that conviction, not charisma, is the true accelerant of long-term growth.

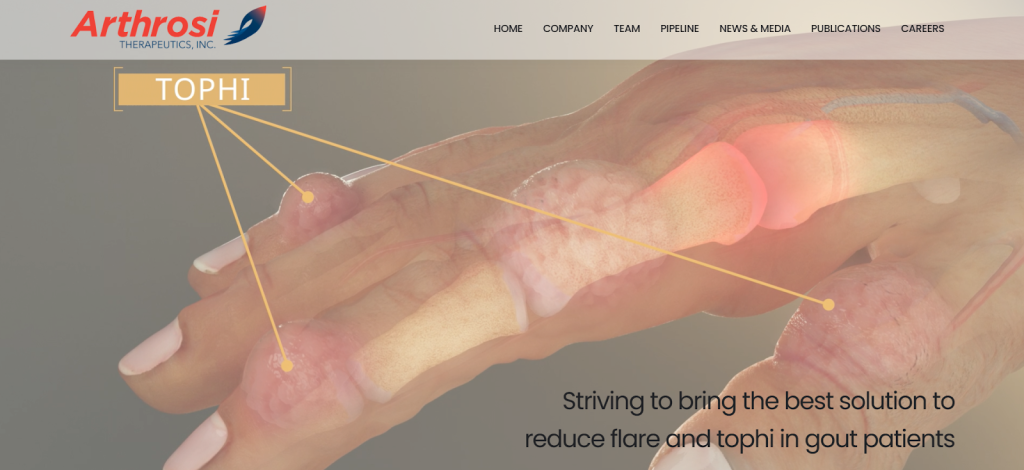

Gout: The Overlooked Epidemic

Globally, gout affects millions, yet it remains one of the most misunderstood metabolic diseases. Traditional urate-lowering therapies often lead to adverse side effects, poor adherence, and limited efficacy in patients with complex comorbidities. Arthrosi’s AR882 aims to change that narrative with a next-generation mechanism that precisely targets uric acid production while preserving renal safety.

If approved, AR882 could represent one of the most meaningful therapeutic advances in gout treatment in decades - potentially improving the lives of patients who have exhausted conventional options.

Strategic Investors and Growth Outlook

The participation of Prime Eight Capital, CR Biotech, HighLight Capital, HM Venture Partners, and ReliantTech Limited signals strong institutional belief in Arthrosi’s approach. These firms have a track record of backing deep-tech and healthcare innovations that reframe entire categories.

With the new funding, Arthrosi is positioned to accelerate its clinical pipeline, invest in manufacturing scale-up, and establish early partnerships for global market access. The company’s long-term goal is clear: build a diversified portfolio of targeted anti-inflammatory drugs that redefine how chronic inflammation is treated.

A Blueprint for Founders in Regulated Innovation

Beyond biotech, Arthrosi’s journey illustrates a broader truth about building in regulated or evidence-based industries. Breakthrough innovation demands patience, scientific integrity, and long-term alignment with investors who understand the rhythm of progress. Yeh’s deliberate strategy - scaling validation before visibility - has enabled Arthrosi to move from the lab to late-stage clinical trials without compromising scientific quality.

The lesson for founders is timeless: don’t rush to prove everything to everyone. Build the few things that matter, prove them conclusively, and let data - not buzz - be your loudest advocate.

As the biotech sector continues to evolve, Arthrosi Therapeutics stands as a model of what’s possible when discipline meets purpose. With $153 million now fueling its next phase, the company is closer than ever to changing the standard of care for gout and setting a new benchmark for precision medicine.