AssetCool Raises $13.6M to Revolutionize Power Grid Efficiency with Smart Cable Tech

July 10, 2025

byFenoms Startup Research

AssetCool, a UK-based smart infrastructure startup, has raised $13,648,243 in Series A funding, marking a major step forward in its mission to transform the energy sector. The round was led by Energy Impact Partners (EIP), alongside Extantia, Taronga Group, and the Northern Powerhouse Investment Fund, managed by Mercia Ventures. Other participants included Kero Development Partners and Northern Gritstone, all backing AssetCool’s bold vision to upgrade the global power grid with advanced thermal management and monitoring systems.

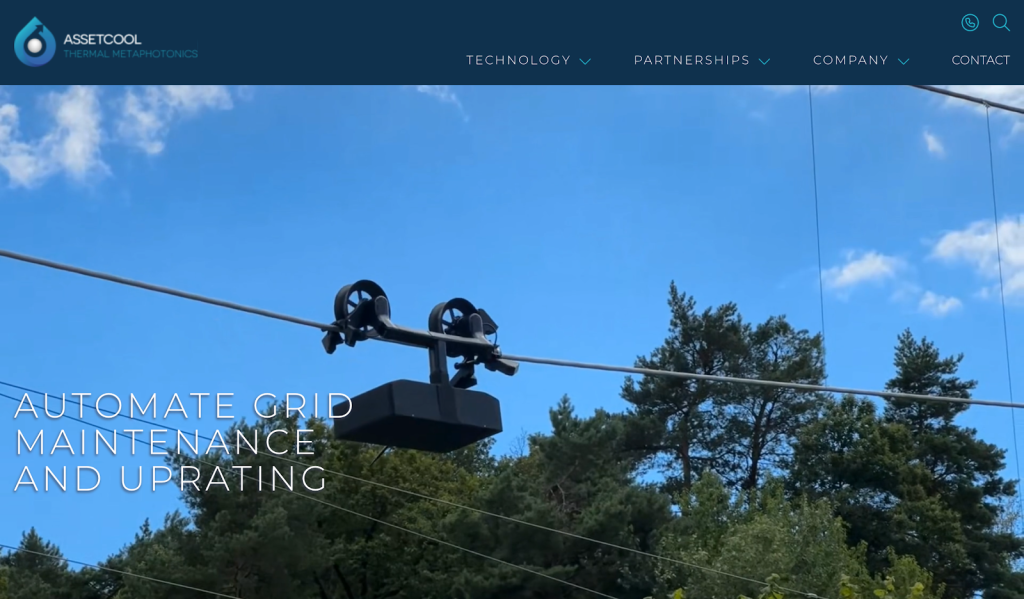

Founded by Niall Coogan, AssetCool offers a game-changing approach to energy infrastructure - enabling utility providers to increase the capacity of their transmission lines without the need for costly replacements. Their proprietary cooling and sensing technologies help utilities combat overheating and line sag, which are major challenges for aging grid systems across the world.

At its core, AssetCool is solving a problem that’s long haunted utility companies: excessive heat buildup on overhead power lines, which limits transmission efficiency and increases risks during high-demand periods. Their proprietary coating technology not only mitigates this heat but also enhances line longevity - unlocking grid capacity without massive hardware overhauls.

What AssetCool is doing is more than an efficiency upgrade - it’s a redefinition of grid economics. Their cooling solution enables utilities to increase transmission capacity by up to 30% without rebuilding infrastructure, aligning perfectly with net-zero grid expansion goals.

The Problem: Aging Infrastructure Meets Renewable Demands

Power grids, especially in Europe and the United States, are facing a critical bottleneck. With aging infrastructure and rising energy consumption - particularly from renewable energy sources - utilities are scrambling to upgrade or replace existing lines. Yet full replacements are expensive and time-consuming.

AssetCool enters the scene with a non-invasive retrofit solution. Their smart coatings and embedded fiber optic sensors enhance both thermal and operational performance of overhead power lines, reducing heat build-up while monitoring real-time performance metrics. This means utilities can push more power through existing lines without overhauling entire systems - a serious win in both cost and carbon terms.

Backing from Top Climate-Focused Funds

AssetCool’s strategic investor roster reflects strong conviction from global sustainability players. Energy Impact Partners (EIP), a major force in climate tech investing, is known for supporting companies tackling grid resilience and emissions reduction. Extantia and Taronga Group are similarly climate-forward, and Northern Gritstone, a university-led investor group, focuses on scaling advanced research from UK institutions into globally impactful ventures.

This syndicate offers not just capital, but deep domain expertise, partnerships, and network effects in the utility, energy, and infrastructure markets.

Why It Matters Now

The global shift toward electrification, especially driven by the adoption of EVs and renewables, is putting intense pressure on transmission networks. According to the International Energy Agency (IEA), $820 billion will need to be invested globally into electricity grids annually by 2030 to support climate goals.

In the UK alone, National Grid estimates it must connect 50GW of new offshore wind by 2030. Traditional upgrade approaches would cost billions and take years. AssetCool offers a fast-track alternative, enabling upgrades that align with climate deadlines - without breaking budgets or carbon targets.

Their solutions also speak to resilience: as heatwaves become more common, cable sag and thermal overloads risk causing blackouts. Real-time monitoring and thermal protection are not just value-adds - they're quickly becoming necessities.

Moreover, as electric vehicle adoption surges and industries electrify, the grid’s role becomes even more central - not just in supplying energy, but in doing so safely, efficiently, and sustainably. Traditional grid upgrades are not only costly but slow-moving. AssetCool’s product provides a lightweight, scalable, and impactful alternative.

What’s Next for AssetCool

With this funding, AssetCool plans to scale manufacturing, expand international deployments, and deepen R&D for next-gen smart coatings and analytics. Expect to see partnerships with major European and North American utilities in the coming months, as the need for scalable grid solutions becomes more urgent.

Their go-to-market strategy is razor-sharp: target transmission providers under pressure to boost capacity fast and work within strict regulatory frameworks. The value proposition - 20-40% increase in line capacity, no line replacement required - makes for a compelling ROI.