Aven Raises $110 Million in Series E to Redefine Consumer Credit

September 12, 2025

byFenoms Start-Up Research

Aven, a fast-growing fintech startup led by Sadi Khan, has secured $110 million in Series E funding, a milestone that underscores its mission to transform how homeowners access credit. The round attracted backing from some of the most influential investors in the venture capital ecosystem, including Khosla Ventures, General Catalyst, Caffeinated Capital, GIC, Electric Capital, and Founders Fund.

This funding round propels Aven into the spotlight as one of the most ambitious players in fintech, setting its sights on making credit more affordable, transparent, and accessible for homeowners across the United States.

Reinventing the Credit Card for Homeowners

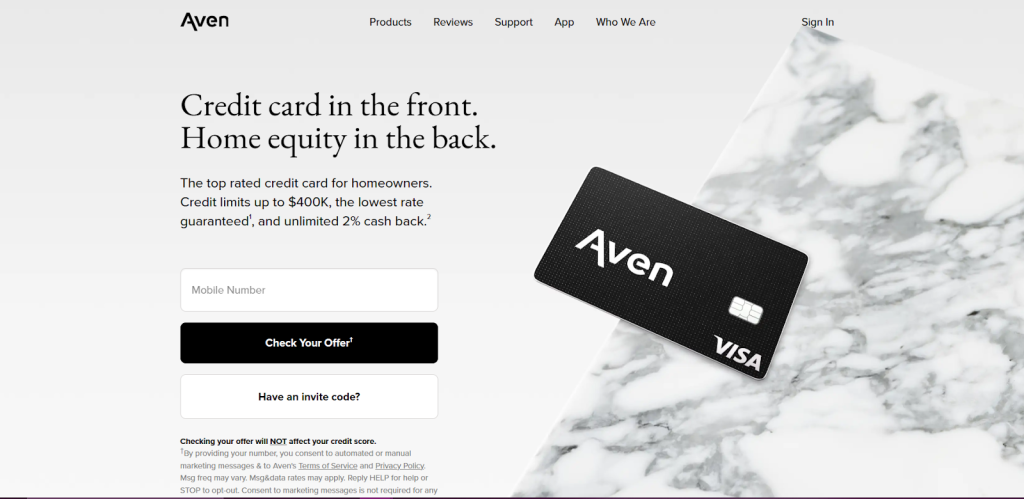

At the core of Aven’s offering is a product that combines the convenience of a credit card with the financial power of home equity. Traditional credit cards come with high interest rates and limited borrowing capacity, while home equity loans can feel cumbersome and restrictive. Aven’s innovation sits squarely between these two worlds: a credit card backed by home equity, offering credit limits up to $400,000, the lowest rate guarantee, and unlimited 2% cash back.

This model represents a fundamental shift in consumer finance by unlocking dormant equity in a way that is simple, flexible, and instantly usable, positioning Aven as a disruptive force in a trillion-dollar market.

Why Aven’s Model Resonates

What makes Aven stand out is its ability to merge two previously siloed financial products - credit cards and home equity - into a seamless solution. For homeowners burdened by expensive credit card debt, the ability to borrow at lower rates backed by their equity is a game-changer. It effectively transforms homeownership from a static asset into a dynamic financial tool that supports everyday spending while maintaining long-term security.

But perhaps the deeper insight lies in how Aven approaches timing and scalability. The fintech ecosystem is crowded with startups offering niche lending products, yet very few solve both consumer pain points and institutional investor priorities simultaneously. Aven’s strategy shows founders the importance of building products that not only excite consumers but also appeal to capital providers. By offering homeowners a fairer credit structure while de-risking the lending model through equity-backed security, Aven has created a dual-sided proposition that satisfies both growth and stability. This is a valuable lesson for founders: designing products with aligned incentives across stakeholders often attracts stronger, long-term capital support than building solely for end users.

Investor Confidence Signals Market Potential

The lineup of investors in this round underscores the scale of Aven’s opportunity. Khosla Ventures and General Catalyst are renowned for backing category-defining startups, while Caffeinated Capital and Electric Capital bring deep expertise in fintech innovation. The participation of GIC, a sovereign wealth fund, highlights the global institutional interest in Aven’s model, while Founders Fund adds strategic weight with its proven track record in scaling disruptive companies.

The diversity and caliber of investors point to strong confidence in both Aven’s business fundamentals and its ability to scale nationally, and potentially globally, in the coming years.

Growth Plans and Use of Funds

With $110 million secured, Aven plans to expand its product offering, grow its customer base, and invest heavily in technology infrastructure. Key priorities include:

- Product Innovation: Enhancing the credit platform to support more flexible repayment structures and integrations with digital wallets.

- Customer Acquisition: Scaling marketing efforts to reach homeowners across all major U.S. markets.

- Risk Management: Strengthening underwriting systems to ensure sustainable growth and maintain the lowest rate guarantee.

- Team Expansion: Hiring top-tier talent in engineering, risk modeling, and customer experience to support rapid scaling.

By focusing on these pillars, Aven is positioning itself not just as another fintech startup but as a financial institution of the future.

The Bigger Picture in Fintech

The rise of Aven reflects a broader shift in consumer finance where innovation centers on unlocking efficiency and fairness rather than simply digitizing existing systems. As homeowners face rising interest rates and higher costs of living, solutions like Aven provide a pathway to responsible borrowing at scale.

With its latest funding, Aven is well-equipped to challenge traditional banks and credit institutions, potentially reshaping how millions of Americans think about credit, equity, and financial flexibility.