Basic Capital Raises $25M Series A to Supercharge Retirement Saving Innovation

September 1, 2025

byFenoms Start-Up Research

Led by founder and CEO Abdul Al-Asaad, Basic Capital has secured a $25 million Series A funding round from top-tier investors including Forerunner and Lux Capital, with additional strategic contributions from SV Angel, Box Group, Henry Kravis, HOF Capital, and Inspired Capital.

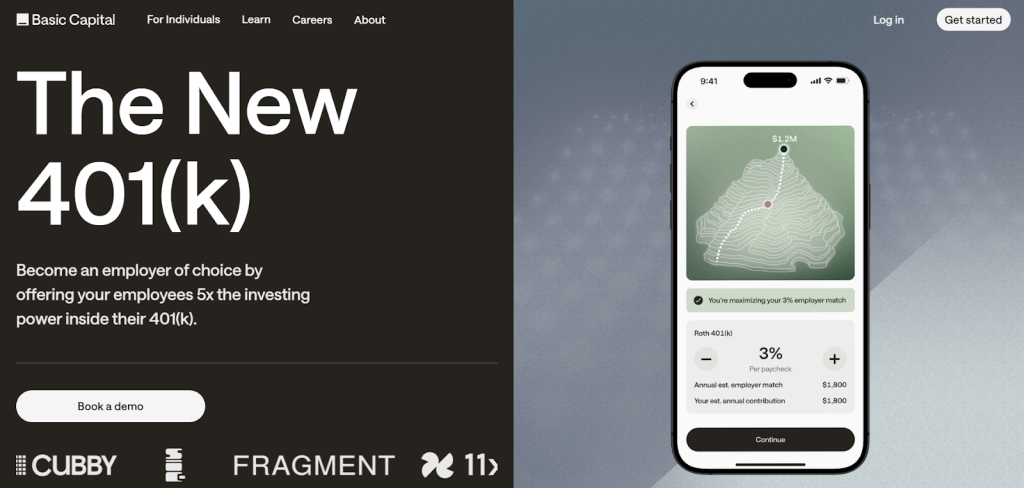

Basic Capital is on a mission to modernize 401(k) and IRA plans by offering participant financing and access to alternative assets, reframing retirement investing entirely. Their innovative model - described by some as a “mortgage for your 401(k)” - gives savers up to $4 of investing power for every $1 contributed, bypassing the shortfalls of margin loans and outdated structures.

A New Lever for Retirement

For decades, 401(k) vehicles have relied on steady contributions and market growth - but many savers lack scale or flexibility. Basic Capital changes that by offering financing through a structured LLC solution, allowing participants to invest more aggressively while retaining control. Unlike volatile margin loans, their structure avoids margin calls and frequent revaluations, making it safer for long-term compounding.

The company has already signed dozens of businesses in its first few months - primarily small companies averaging around 100 employees - and plans to expand upmarket into mid-sized employers with workforces between 500 and 2,000. And this is where the real insight for founders lies: instead of chasing the biggest players first, Basic Capital deliberately built traction with smaller firms that could adopt faster and serve as proof points. This go-to-market sequencing shows how startups can create undeniable leverage in fundraising conversations - when you demonstrate that even limited-scale customers are generating demand and early wins, investors see a path to scalability rather than just a bold vision. In other words, product innovation is only half the equation; timing and sequencing of adoption can determine whether capital flows in or stalls out.

Expanding the Solution

With the new funding, Basic Capital aims to:

- Expand employer adoption across broader markets and self-directed IRAs

- Invest in technology and compliance infrastructure to scale safely

- Grow the team in engineering, product, and sales to support rapid onboarding and partnership development

Why the Timing Is Right

Recent regulatory shifts are making alternative asset integration into 401(k) plans easier, echoing Basic Capital’s model - and prompting aligned federal attention. While leverage and private credit raise concerns about fees and liquidity, Al-Asaad argues that the bigger risk is remaining unleveraged in a compounding economy.

His backers believe the model balances financial sophistication with safety, enabling everyday savers to access amplified growth - not higher risk.

What This Means for Employers and Savers

As retirement accounts struggle with low yield environments and flat contribution rates, Basic Capital offers a dual win for both employers and employees. Employers can offer differentiated benefits without exacerbating costs, while savers gain extra investing power - potentially turning modest portfolios into meaningful nest eggs, especially for long-tenured contributors.

What’s Next

In the coming months, expect Basic Capital to:

- Extend financing offerings beyond retirement accounts into adjacent savings vehicles

- Scale partnerships with enterprise HR platforms and plan providers

- Deepen educational outreach to mitigate hesitancy around leveraged retirement strategies

The company isn’t merely updating 401(k)s - it’s pioneering a whole new way of building wealth through structured leverage that is safe, compliant, and compounding.