Big Rentals Raises $2.8M to Build the Largest Trailer Rental Marketplace in the U.S.

November 30, 2025

byFenoms Startup Research

Big Rentals has raised $2.8 million in Seed funding, accelerating its mission to transform how Americans access trailers, heavy equipment transport, and towable rentals. The round - backed by SNAK Venture Partners, NuFund Venture Group, Ironspring Ventures, Forum Ventures, and others - marks a pivotal moment in a sector that has remained fragmented, offline, and operationally inconsistent for decades.

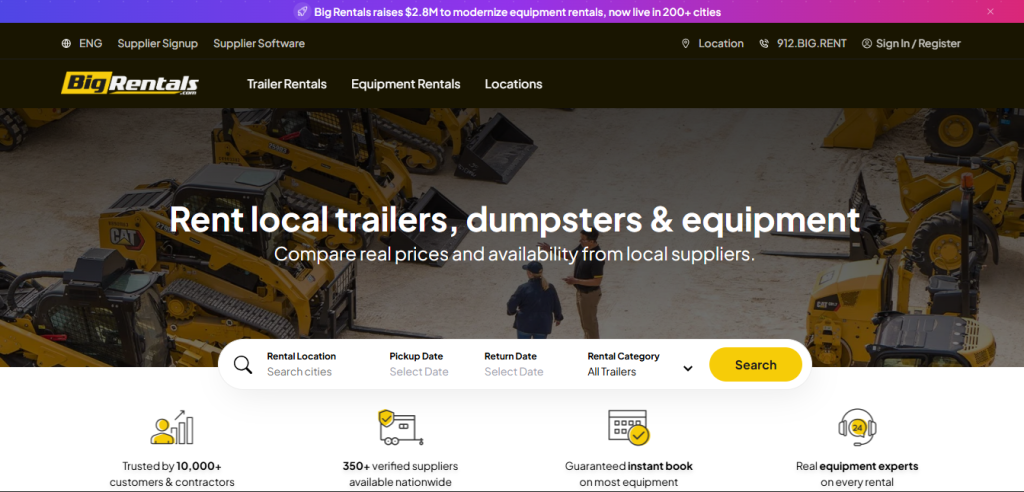

Led by CEO Pablo Fernandez, Big Rentals is building a unified national platform where customers can find, compare, and book trailers from thousands of trusted rental operators. Instead of calling multiple local shops, deciphering mismatched pricing, or navigating outdated websites, renters get one digital marketplace with real availability, verified listings, and seamless transactions.

This funding positions Big Rentals to scale its supply network, expand to new regions, and become the digital backbone of a high-demand but historically underserved rental industry.

The Fragmented Reality of Trailer Rentals

The U.S. trailer rental market is far larger than most people realize. Millions of individuals and businesses - from contractors to landscapers to weekend movers - rent trailers every year. Yet more than 75% of trailer rental businesses operate offline, taking bookings through phone calls, paper calendars, and manual coordination.

The consequences are predictable:

- Customers waste time tracking down availability

- Pricing varies wildly with no transparency

- Operators lose revenue to no-shows and mismanaged schedules

- Capacity utilization stays low because most inventory is invisible online

Industry analysis shows the trailer and utility rental category is valued at over $10 billion annually in the U.S., and demand continues to grow with the rise of gig logistics, small-scale construction, and independent contractor services.

But despite this demand, the digital evolution of the industry is lagging behind. Only 1 in 10 rental operators offer real-time online booking, and an even smaller fraction provide verified listings with standardized equipment details.

Big Rentals is stepping directly into this gap.

A Centralized Marketplace That Finally Works

Big Rentals solves the two biggest pain points in the category:

discoverability and trust.

By aggregating thousands of trailers into one marketplace and verifying each listing, the company gives customers a more reliable rental experience - while giving operators a way to reach broader demand efficiently.

The platform standardizes:

- Trailer categories and specifications

- Daily and weekly pricing

- Availability calendars

- Pick-up instructions

- Damage and protection policies

This uniformity is a massive upgrade for both sides. Renters get clarity. Operators get consistent booking infrastructure. And the industry gets a digital layer that finally makes renting a trailer feel as modern as booking a hotel.

The Insight: Infrastructure Wins - Not Inventory

Here’s the ultra value drop founders will appreciate:

The most defensible marketplace models aren’t the ones that own inventory - they are the ones that standardize chaos and become the operating layer everyone relies on.

That’s exactly what Big Rentals is doing.

The power is not in having more trailers than anyone else. The power is in:

- structuring fragmented supply,

- enforcing quality and reliability,

- and ensuring operators plug into a system that increases their revenue.

Once operators start depending on the platform for bookings, insurance flows, customer management, and predictable demand, Big Rentals becomes the infrastructure - not just another marketplace. And once a marketplace becomes infrastructure, expansion compounds rather than resets.

This is the same pattern that created category leaders in travel, food delivery, and property rentals. Trailer rentals are simply the next frontier.

Why Now? The Industry Is at a Digital Tipping Point

The timing for Big Rentals couldn’t be better.

Several macro trends are pushing the industry online:

- The construction and contracting workforce is projected to grow 4–6% through 2030, increasing trailer usage.

- Small logistics businesses grew 15% last year, driven by e-commerce and short-haul transport - both heavy users of towable equipment.

- Equipment rental overall is forecasted to exceed $65 billion by 2028, with digital-first platforms capturing a growing share.

- Inflation and high vehicle ownership costs are driving a shift toward renting over buying.

These forces mean more individuals and businesses need trailers, and they need them fast. A unified digital marketplace is no longer optional for the industry - it’s inevitable.

Big Rentals is simply the first to build it at scale.

Expanding the Network Nationwide

With $2.8M in fresh capital, Big Rentals is planning to:

- Increase its marketplace inventory across all major metro areas

- Onboard more small and mid-sized rental operators

- Enhance its verification and vetting systems

- Build advanced routing, protection, and scheduling tools

- Expand into related categories such as equipment haulers and specialty trailers

- Strengthen partnerships with enterprise rental groups

The company’s long-term vision is to become the default national marketplace for trailer rentals, the same way Airbnb became the default for short-term stays.

What Comes Next

The trailer rental category is ready for modernization, and Big Rentals has both the timing and structure to lead the transformation. With strong investor backing, a rapidly growing supply network, and increasing demand from small logistics and contracting businesses, the company is entering its scaling phase at full speed.

As the marketplace expands, customers will gain unprecedented access, operators will unlock new revenue, and the industry will finally get the digital infrastructure it has needed for years.

Big Rentals isn’t just building a rental site. It is building the operating system for America’s trailer rental economy - and the next phase of growth is only beginning.