Bilt Raises $250M to Reinvent Rent Payments and Unlock Homeownership for Millions

July 30, 2025

byFenoms Startup Research

Bilt, the fintech startup transforming rent into a financial asset, has raised an impressive $250 million in a new funding round led by General Catalyst, GID, and United Wholesale Mortgage. The round pushes the company’s valuation to over $3.1 billion, marking a major leap for the rent-tech category and one of the largest raises in fintech this year.

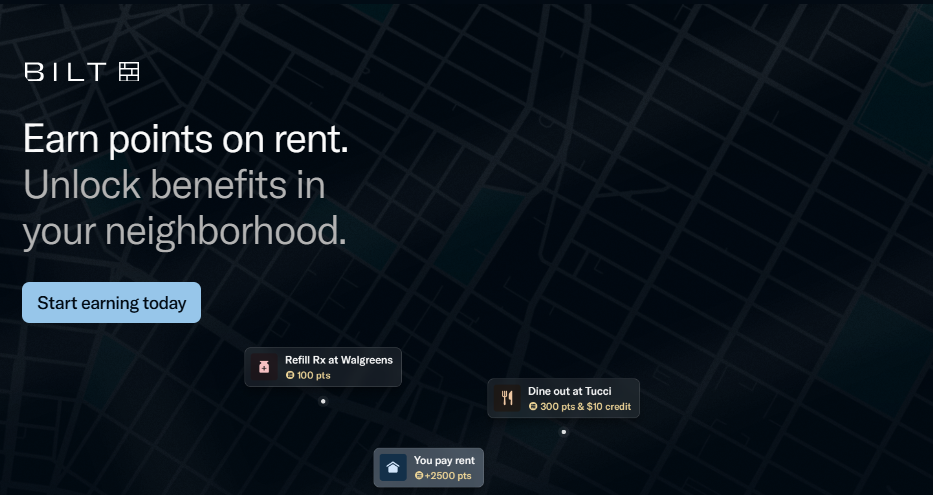

Founded by Ankur Jain, Bilt empowers renters to pay rent via its platform and earn rewards, build credit, and even convert those rewards into down payments on homes - turning rent, traditionally a sunk cost, into a launchpad for long-term financial mobility.

Turning Rent Into a Financial Engine

In the U.S., over 100 million renters pay trillions of dollars annually, yet until recently, rent payments didn’t impact credit scores or qualify for any rewards. Bilt is changing that narrative.

Through its Bilt Mastercard and Bilt Rewards platform, users can now earn points on rent payments - without fees - and redeem them for travel, fitness, Amazon purchases, or a mortgage down payment. Meanwhile, all rent activity is reported to the credit bureaus, helping users build their FICO score just by doing what they already do: pay rent.

The company has partnered with over 4 million rental units, creating a coast-to-coast network that includes property managers, student housing, and co-living operators.

“We’re not just redefining rent - we’re redefining access to financial opportunity,” said founder and CEO Ankur Jain.

Why This Round Signals a Bigger Shift

According to the Harvard Joint Center for Housing Studies, homeownership among millennials is nearly 15% lower than the national average, while 35% of renters under 40 say they feel locked out of the housing market for good. Simultaneously, TransUnion reports that 70% of renters want their payments to count toward credit, yet fewer than 5% of landlords offer it.

With housing affordability at a 40-year low, Bilt is solving a structural problem: how to build ownership pathways from a system never designed to provide them.

But it’s not just the offering - it’s the delivery model. Bilt’s success lies in how it embeds financial improvement directly into an unavoidable, recurring expense. Rent isn’t optional, which means Bilt doesn’t need to rely on user motivation or education to create engagement.

The best fintechs don’t force users to change behavior - they redirect value from what’s already happening. Bilt didn’t build a new habit; it intercepted an existing one and compounded it with upside.

If you’re building in fintech, ask yourself:

Is your product offering net new behavior, or latent value unlocked from behavior that already exists?

Because products that align with existing user flows don’t just convert - they scale. Bilt’s genius wasn’t in creating a flashy interface. It was in making the most invisible payment - rent - finally visible and valuable.

This strategic alignment of value and behavior is what makes Bilt more than just a payment platform - it’s a gateway into financial transformation.

The Backers Fueling Bilt’s Expansion

The $250 million Series C includes a dream team of institutional players:

- General Catalyst, known for early bets on Airbnb, Stripe, and Lemonade

- GID, a global real estate firm managing over $29 billion in assets

- United Wholesale Mortgage, the top mortgage lender in the U.S., offering backend muscle for Bilt’s homeownership mission

With this backing, Bilt is well-positioned to push deeper into both fintech and real estate infrastructure.

A Fintech Platform Built to Scale

Beyond its rewards program and credit-building tools, Bilt is rapidly evolving into a financial superapp for renters:

- Homeownership tools: Bilt lets users track mortgage eligibility, simulate down payments, and convert reward points into equity

- Dynamic rewards: Points can be used with travel partners like American Airlines, Hyatt, and IHG

- Rent tracking: Rent payments improve credit with all three major bureaus

- Flexible payments: Tenants can pay via card even when landlords don’t accept them

All of this sits on top of Bilt’s no-fee payments engine, which removes the friction typically associated with paying rent via credit card.

What’s Next for Bilt

With fresh funding, Bilt will focus on:

- Expanding its property network into smaller landlords and international markets

- Rolling out embedded mortgage pre-approval with United Wholesale Mortgage

- Growing strategic partnerships in travel, retail, and wellness

- Building out proprietary homebuying insights powered by user-level financial data

The company is also expected to invest heavily in machine learning models that predict mortgage-readiness, aiming to shorten the timeline between “renter” and “homeowner” from years to months.

Market Outlook: The Rent-to-Own Revolution

The U.S. rental market exceeds $500 billion annually, with proptech investment surging across B2C and B2B layers. According to CB Insights, rent-tech investment jumped 250% year-over-year in 2024, with rising interest in embedded finance and tenant retention solutions.

But what Bilt has built isn’t just proptech or fintech - it’s transitional tech: a bridge between living expenses and wealth creation.

By turning rent into an on-ramp for financial freedom, Bilt is not just giving people points. It’s giving them a plan.