FitFeast Raises $643,286 in Seed Round to Reinvent On-the-Go Nutrition

July 10, 2025

byFenoms Startup Research

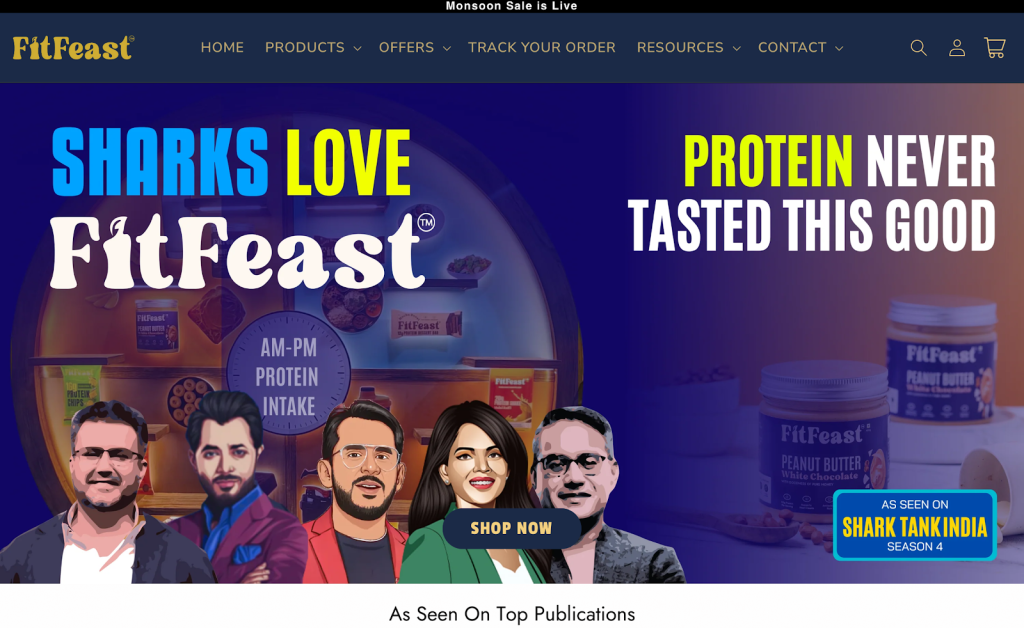

FitFeast, a promising new player in the health and nutrition space, has raised $643,286 in their Seed Round led by Inflection Point Ventures. Co-founded by Aditya Poddar, FitFeast aims to disrupt the on-the-go nutrition market with its line of protein-rich shakes that prioritize flavor, texture, and nutrition - all in a convenient, ready-to-consume format. The company is solving a common pain point in the wellness market—making functional, performance-driven beverages that are also enjoyable and accessible for daily consumers.

What FitFeast Offers

FitFeast is addressing one of the most persistent gaps in the health food industry: how to make nutritious products taste as good as they perform. Their current offerings - marketed as protein shakes that deliver on taste - have already generated attention after their pitch on Shark Tank India. With their smooth textures, bold flavors, and scientifically-backed ingredients, FitFeast aims to position itself as the go-to solution for fitness-conscious consumers who don’t want to compromise on flavor or function.

The brand's product line is developed with input from nutritionists and fitness professionals, aligning its nutritional profiles with India’s growing demand for performance-driven wellness products.

Why This Seed Round Matters

Raising nearly $650K at the seed stage validates the market opportunity FitFeast is addressing. The round, backed by Inflection Point Ventures, gives the company a strong financial footing to scale product development, enhance marketing efforts, and expand retail channels.

This capital is also expected to go into expanding FitFeast’s R&D team to develop new flavors and improve the nutritional profile of its existing products.

The Real Leverage Founders Should Be Chasing

Here’s where FitFeast’s play becomes more than just another protein brand. Most consumer startups over-index on the product - building for a perfect formula before knowing whether their customer habits support frequent usage. What FitFeast seems to understand is this: you don’t just need product-market fit - you need consumption-loop fit.

That means building a product that naturally integrates into someone’s daily rhythm - post-gym, mid-commute, or in between meetings. By optimizing for not just flavor and nutrition but repeatability and timing, FitFeast is engineering loyalty by design. For early-stage founders in the consumer health space, this is a critical insight: build for the moment your customer already has, not for a moment you have to teach them to create.

The Health & Wellness Market: Why Timing Matters

The global protein supplement market was valued at $20.47 billion in 2021 and is projected to grow to $32.56 billion by 2027 at a CAGR of 7.2%. Meanwhile, India’s health food sector is experiencing explosive growth. According to FICCI, the Indian health and wellness food market is expected to cross $30 billion by 2026, driven by rising income levels, fitness awareness, and lifestyle shifts among millennials and Gen Z.

In particular, the ready-to-drink (RTD) protein beverage subsegment is gaining traction among urban consumers. These buyers are not just looking for performance—they want convenience without compromise. A 2023 report by ResearchAndMarkets shows that the Asia-Pacific region is the fastest-growing market for RTD health drinks, with India expected to be a major contributor due to its young, fitness-conscious population and increasing gym penetration.

Additionally, growing e-commerce adoption and D2C health brands have made it easier than ever for niche products like FitFeast to reach loyal communities online and scale efficiently without the overhead of traditional distribution.

The Hidden Leverage That Most Founders Miss

Here’s the strategic edge that FitFeast seems to understand deeply - and what other consumer health startups often miss: distribution precedes differentiation. It’s not enough to have the best-tasting protein shake on the shelf if you’re buried under a hundred SKUs at the back of a store.

FitFeast’s early moves suggest a strategy built on velocity at point-of-sale, tight supply chain control, and smart packaging design for visibility. For founders entering the crowded consumer health market, the playbook isn’t just about products - it’s about owning the real estate in the customer’s daily routine. FitFeast appears to be building precisely for that.

Why the Nutrition Market Is Ripe for Innovation

The global protein supplement market reached $20.47 billion in 2021 and is projected to hit $32.56 billion by 2027, with a compound annual growth rate (CAGR) of 7.2%. Ready-to-drink protein shakes are leading this surge, especially in Asia-Pacific markets where fitness adoption is outpacing infrastructure.

In India alone, the health and wellness food segment is projected to cross $30 billion by 2026, driven by an increasingly urbanized middle class and heightened health awareness post-COVID.

Yet the challenge remains: taste fatigue and unengaging packaging have hindered product loyalty in this space. FitFeast is addressing this head-on, building not just a nutrition brand but a lifestyle brand that taps into emotional satisfaction, aesthetic branding, and habitual convenience.

What’s Next for FitFeast

The startup plans to deploy its fresh funding toward product innovation, flavor expansion, and regional logistics. FitFeast is also exploring collaborations with fitness chains and co-branded campaigns with wellness influencers to expand its visibility. The capital will further bolster their D2C infrastructure, allowing for a tighter feedback loop between customers and the product team.

As India's protein consumption habits mature, FitFeast is poised to be more than a protein shake - it’s building the next generation of functional food experiences for the masses. In a market flooded with bland, chalky protein products and uninspiring branding, FitFeast is building a nutrition experience that feels both premium and personal - an approach that could redefine how Indian consumers view everyday health food.