FoodHealth Company Raises $7.5M Series A to Personalize Nutrition at the Retail Shelf

July 28, 2025

byFenoms Start-Ups

In a major step forward for personalized food-as-medicine innovation, FoodHealth Company (formerly known as bitewell) has raised $7.5 million in Series A funding, led by a dynamic mix of impact-driven and healthcare-focused investors. The round included participation from Reach Capital, Ulu Ventures, Supply Change Capital, ReThink Food, Refinery Ventures, Antler, and others, with Samantha Alexander at the helm of this transformation.

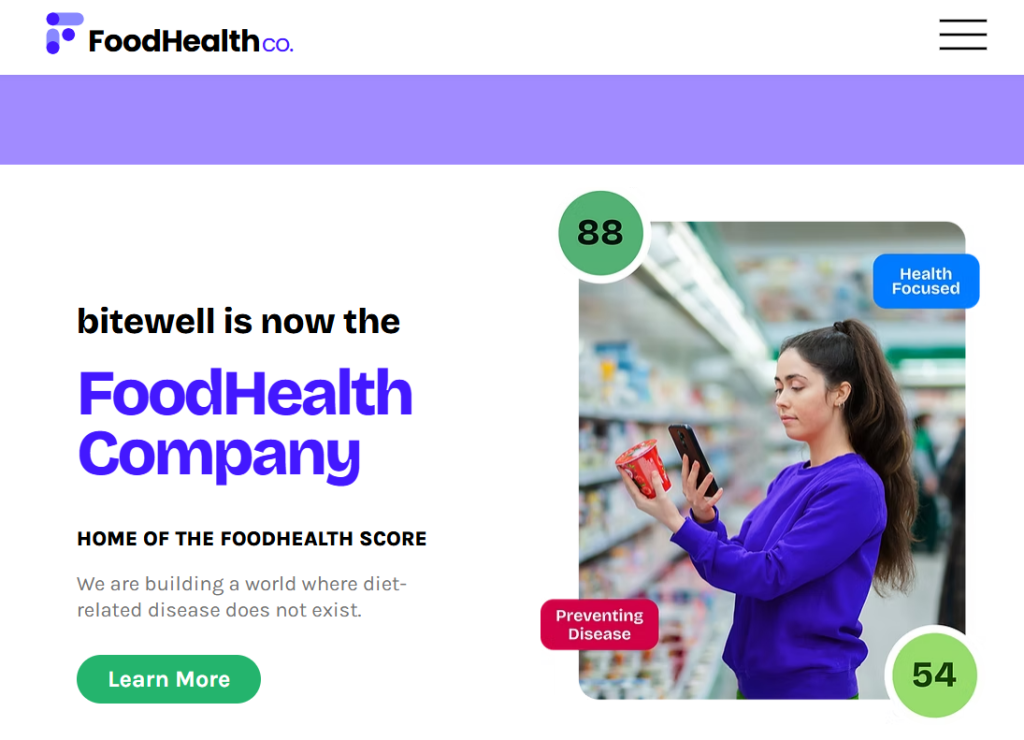

Rebranding from bitewell to FoodHealth Company, the startup is sharpening its focus on making personalized, health-informed food decisions possible - right at the point of purchase, whether online or in-store. This funding marks a pivotal moment in the broader foodtech and digital health landscape as investors double down on data-powered nutrition.

What FoodHealth Company Is Solving

Today’s food system is built for mass distribution, not individual health. While apps count calories and retailers label macros, the granular personalization of nutrition - based on medical conditions, goals, allergies, or medications - is still largely inaccessible to the average consumer.

FoodHealth Company bridges this gap by offering a FoodHealth Score™, a personalized nutrition rating system that integrates with grocery platforms, meal services, and even prescription benefit tools. The score considers chronic conditions like diabetes or heart disease, dietary preferences, allergens, and fitness goals, then ranks foods accordingly to guide smarter decisions.

Their platform sits at the convergence of:

- Clinical-grade nutrition data

- Grocery shopping behavior

- Digital health integration (HSA/FSA, Rx, etc.)

- Retail partnerships to drive last-mile influence

Instead of telling users what to eat, FoodHealth Company shows them what to buy - and backs it up with evidence and real-time alternatives.

Behind the Scenes: Building Trust Through Contextual Design

One of the most compelling elements of FoodHealth Company's strategy lies in how they’ve embedded their score into the actual shopping journey - not as an external tool, but as a natural part of the decision-making process.

Rather than trying to change habits outright, they’ve made health-focused choices feel like the default. It’s this contextual design that removes friction - users don’t have to search for answers; the answers appear when and where they’re needed.

And here’s a powerful insight for founders building in complex or regulated spaces: Your product must become a layer, not just a destination.

Too many startups aim to be the one-stop shop - the app, the marketplace, the content hub. But most consumers don’t want to “go somewhere” to solve a problem. They want that solution embedded where they already are.

FoodHealth Company isn’t trying to disrupt grocery stores. They’re rewiring them.

If you’re a founder building in health, fintech, or foodtech - think less about being the platform and more about being the protocol. Think about distribution as infrastructure, not just marketing.

Why the Market Is Catching Fire

Food as medicine is no longer a fringe wellness concept. It’s now central to policy discussions, insurance innovation, and chronic care management strategies.

- According to the CDC, 6 in 10 adults in the U.S. live with a chronic disease, many of which are nutrition-sensitive.

- A 2023 NIH study found that over 70% of healthcare costs are preventable through dietary and lifestyle changes.

- The food-as-medicine market is projected to grow to $27.3 billion by 2030, up from $9.5 billion in 2022 (source: Global Market Insights).

Retailers are taking note. Walmart, Kroger, and Amazon Fresh are actively building nutrition-focused partnerships. Insurance companies are exploring medically tailored meal reimbursements. And digital health platforms are looking for ways to integrate food-based protocols into patient engagement flows.

The convergence of food, health data, and commerce is happening fast - and FoodHealth Company sits right at that crossroads.

Investor Confidence and Ecosystem Alignment

The composition of this Series A investor group reflects a deliberate strategy. Funds like Reach Capital and Ulu Ventures have a history of backing mission-driven ventures with scalable infrastructure, while Supply Change Capital is known for investing in founders rethinking food systems through equity, sustainability, and access.

Refinery Ventures brings operational scale experience, and Antler has backed some of the fastest-growing early-stage consumer startups. Their combined support provides FoodHealth Company with not just capital, but distribution, retail alliances, and policy navigation insight.

Expect to see more partnerships with health plans, retailers, and wellness employers as FoodHealth Company extends the reach of its FoodHealth Score™.

What’s Next for FoodHealth Company

Armed with fresh capital, the team plans to expand its engineering and retail integration capabilities, deepen partnerships with health benefit administrators, and bring the FoodHealth Score™ into prescription nutrition ecosystems.

The company’s north star? Making it possible for every American to understand the health impact of the food they’re about to buy - without needing a degree in nutrition science.

Whether that’s a mom shopping at Target, a diabetic choosing lunch via DoorDash, or a senior managing hypertension on a Medicare Advantage plan, FoodHealth Company is building a common language between food, health, and outcomes.