Mazlo Raises $4.5M Seed Round to Reimagine Nonprofit Finance

September 22, 2025

byFenoms Start-Up Research

Mazlo, a fintech startup transforming the way nonprofits manage finances, has successfully raised $4.5 million in seed funding. The round was led by an impressive group of investors including Andreessen Horowitz, Social Good Fund, Westbound Equity Partners, and super{set}, highlighting growing confidence in the startup’s mission to modernize compliance-driven banking for the nonprofit sector.

Founded by Kian Alavi, Mazlo is reimagining financial infrastructure for organizations that have long been underserved by traditional banking systems. Nonprofits often face complex challenges when it comes to compliance, reporting, and transparent money movement. Mazlo’s platform is designed to simplify these challenges, offering a streamlined banking experience that empowers nonprofits to focus on their mission rather than paperwork.

The rise of mission-driven fintech

The nonprofit sector represents a multi-trillion-dollar global economy, yet it has historically been underserved by innovation. Traditional banks offer generic services that rarely account for the regulatory, compliance, and donor-trust requirements unique to nonprofit organizations. Mazlo enters this space with a fresh perspective, building a financial platform specifically tailored to nonprofits and their operational realities.

Its banking tools not only facilitate everyday transactions but also ensure compliance in real time. This removes a heavy burden from nonprofit leaders, who often juggle limited resources while trying to meet strict regulatory requirements.

Strong investor backing underscores opportunity

The participation of Andreessen Horowitz - a name synonymous with transformational tech investments - signals the magnitude of the opportunity Mazlo is pursuing. Combined with Social Good Fund and other mission-aligned partners, the funding round gives Mazlo the capital and strategic network it needs to scale rapidly.

For many investors, this represents a chance to back infrastructure that strengthens the nonprofit ecosystem, enabling more impact per donated dollar. With nonprofits playing such a critical role in solving societal challenges, financial innovation in this sector is more than a business opportunity - it’s a social necessity.

And here’s where the deeper insight for founders emerges. Mazlo’s success illustrates that massive opportunities often exist in overlooked markets. Startups tend to chase crowded categories - fintech for consumers or SMBs, for instance - while enormous pain points remain unaddressed in specialized verticals. The ultra value drop is this: founders who identify under-innovated but essential sectors can unlock “blue ocean” opportunities where competition is minimal but impact is vast. Nonprofits may not be a flashy market compared to consumer payments, but the scale of inefficiencies is huge, and solving them creates defensible value. For any founder, the lesson is clear - sometimes the most transformative startups are born not from following the hype but by solving real, systemic problems in forgotten corners of the economy.

Building compliance-driven banking for nonprofits

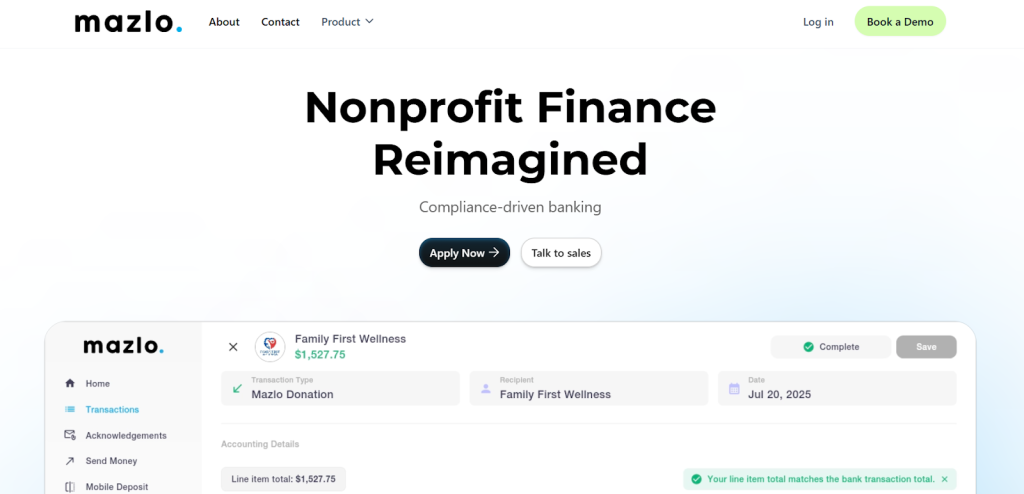

Mazlo’s product design centers around compliance from day one. Rather than retrofitting financial tools to meet regulatory needs, the platform integrates compliance as a core feature. This approach ensures that nonprofits using Mazlo can operate with greater confidence, knowing that audits, donor transparency, and regulatory checks are streamlined.

The platform also emphasizes user experience. Nonprofit administrators often lack deep financial expertise, and Mazlo’s intuitive dashboards make it easy to track transactions, generate reports, and demonstrate accountability to stakeholders. This blend of sophistication and simplicity is what sets the startup apart from legacy financial institutions.

What’s next for Mazlo

With $4.5 million in fresh capital, Mazlo plans to expand its team, accelerate product development, and deepen integrations with nonprofit technology ecosystems. The company also aims to broaden its reach across the U.S. and eventually into global markets where nonprofit organizations face similar financial bottlenecks.

By scaling its platform, Mazlo hopes to become the default banking and compliance layer for nonprofits worldwide. In doing so, it not only modernizes nonprofit finance but also enables mission-driven organizations to redirect more resources toward the causes they champion.

Implications for the broader fintech landscape

Mazlo’s raise reflects a larger trend in fintech: the rise of vertical-specific solutions. Rather than one-size-fits-all approaches, the next wave of financial technology is being designed around the nuanced needs of distinct industries. From healthcare to real estate to nonprofits, fintech platforms that specialize are proving to deliver deeper value and faster adoption.

For the nonprofit world, this represents a long-overdue transformation. As digital finance becomes the norm, donors will increasingly expect transparency, regulators will demand stronger compliance, and nonprofits will need tools that allow them to keep pace. Mazlo’s emergence as a leader in this space underscores the importance of building financial tools not just for profit-driven enterprises but also for organizations dedicated to social good.

Final thoughts

Mazlo’s $4.5 million seed funding round is more than just an early-stage win - it’s a signal of changing tides in the nonprofit finance world. With the backing of top-tier investors and a founder passionate about solving systemic inefficiencies, the startup is positioned to redefine how nonprofits engage with financial systems.

By solving a complex, often overlooked problem with elegant technology, Mazlo is proving that innovation and impact can go hand in hand. For nonprofits, it offers a new path toward financial clarity. For the broader startup community, it offers a reminder that transformative opportunities often lie in unexpected places.