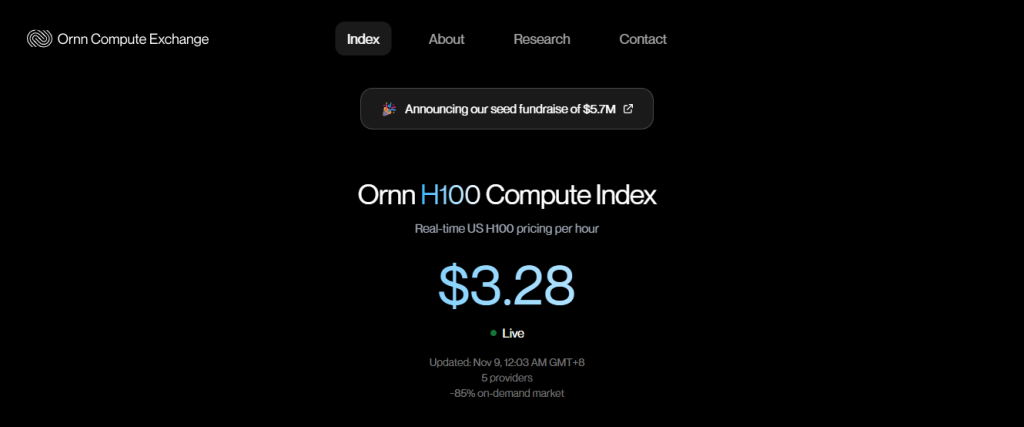

Ornn Raises $5.7M Seed Round to Build the Behavioral Forecasting Engine That Predicts Demand Before Markets Shift

November 8, 2025

byFenoms Start-Ups

Ornn has raised $5,700,000 in their Seed Round, backed by Crucible Ventures, Vine Ventures, Link Ventures, BoxGroup, and other strategic investors. Led by founder Kush Bavaria, Ornn is focused on one core mission: transforming how companies decide what to do next. Instead of relying on historical dashboards or lagging analytics, Ornn forecasts future demand by modeling behavioral patterns. The platform analyzes product usage, customer traction, market signals, and engagement to predict how demand will change before decisions are even made. While most tools explain the past, Ornn gives leaders visibility into the future.

Reframing Go-To-Market Strategy: Not “React When the Market Moves,” but “Know Where the Market Is Going First”

Traditional analytics tools only show what already happened - a snapshot of yesterday. Ornn shifts teams into a proactive operating mode by forecasting how customers, buyers, and markets are likely to behave if a company changes its pricing, messaging, product, or launch strategy. Instead of debating pricing, feature adoption, or marketing angles through gut instinct, companies can simulate outcomes before committing resources. Decisions stop being educated guesses; they become informed bets based on predicted behavior. For the first time, strategy becomes data-driven before the execution begins. In a landscape where timing determines winners, knowing demand before it happens changes everything.

Ornn Isn’t an Analytics Platform - It’s the Behavioral Forecasting Layer That Sits Above Your Data

Most companies have too much data and too little clarity. Ornn overlays your product analytics, CRM, and revenue stack to model demand shifts and reveal what decisions will drive conversion, adoption, or engagement. The platform doesn't just track actions - it interprets behavioral momentum. It identifies when a market segment is heating up, when interest is fading, and when a pricing or feature change could unlock revenue. Because the signals are predictive and directional, Ornn becomes the decision layer that guides what the organization focuses on next. It’s not about visualizing metrics - it’s about creating conviction.

Speed Doesn’t Scale Revenue - Direction Does

Startup culture glorifies moving fast, executing aggressively, and iterating constantly. But speed without direction wastes time and burns capital. What Ornn understands deeply - and what most founders learn too late - is that growth doesn’t come from doing more. Growth comes from doing the right things first. Every sprint that doesn’t drive revenue is a sprint lost. Every campaign that launches without signal is money burned. When Ornn shows which actions have the highest predicted upside, companies spend less time guessing and more time achieving. The unfair advantage is not volume - it’s clarity. The fastest organizations are simply the ones that avoid the wrong decisions early.

Investor Alignment: Crucible, Vine, Link, and BoxGroup Back the New Decision Advantage

Ornn’s investor lineup signals a clear market thesis: the next major enterprise platform won’t just automate workflows - it will influence decisions. Crucible Ventures backs infrastructure-level innovation. Vine Ventures invests in founders building data-driven leverage systems. Link Ventures and BoxGroup have previously backed companies that became core operating layers for modern organizations. Their conviction is that whoever sits closest to decision-making holds strategic power inside a company. Analytics tell the story. Ornn directs the storyline. Investors aren’t betting on another dashboard or insights product - they’re betting on the platform leaders will consult before committing resources.

A Market Shift: Predictive Intelligence Is Becoming the New Competitive Edge

We are at the beginning of the predictive intelligence era. Companies have more data than ever but fewer insights that drive confident action. According to recent industry research, the predictive analytics market is projected to reach $67.9 billion by 2030, and organizations that adopt predictive intelligence outperform competitors by over 2x in revenue growth and nearly 2x in retention. Additionally, 72% of executives admit their current decision-making cadence is slower because they must interpret complex, contradictory data. The demand for tooling that tells leaders what actions will yield the best outcomes is accelerating. Companies don’t just want to look back at performance - they want to see forward into opportunity.

Why Ornn Wins: Demand Is a Behavior, Not a Spreadsheet

Demand isn’t just numbers - it is emotion, timing, context, and readiness. Customers don’t convert because of logic alone; they convert when their behavioral signals align. Ornn captures these signals, models them, and reveals when readiness spikes or drops. By focusing on behavior instead of generic metrics, Ornn gives companies the earliest possible warning of momentum changes. While competitors react to dashboards full of historical KPIs, Ornn users already know where demand is heading and can act first. The company that sees the future doesn’t have to compete in the present.

What’s Next for Ornn

With $5.7M raised, Ornn will expand its forecasting engine, deepen integrations with CRM and product analytics platforms, build forecasting templates for go-to-market teams, and scale into enterprise SaaS, fintech, and marketplace sectors. The long-term vision is to make Ornn the forecasting layer companies open before planning strategy. Eventually, Ornn wants every major business decision - pricing, features, campaigns, product launches - to begin with the same question: “What does Ornn predict?”

Final Thoughts

Companies don’t lose because they lack data. They lose because they lack direction. Ornn gives companies the ability to decide based on future signal instead of past performance. It turns uncertainty into confidence, and confidence into execution velocity. Teams stop moving fast without knowing where they’re going - and start moving precisely toward the highest-probability outcome. Ornn isn’t helping companies think faster. It’s helping them think correctly.