Pathwork Raises $3.5 Million to Transform Insurance Distribution with AI

September 12, 2025

byFenoms Start-Up Research

The insurance industry has long been known for its complexity, slow-moving processes, and reliance on outdated distribution systems. Pathwork, founded by Ian Levinsky and Blake Butterworth, is aiming to change that narrative with an AI-driven platform designed to bring efficiency, speed, and intelligence to how insurance is sold, placed, and retained. The startup has just secured $3.5 million in seed funding, with participation from Costanoa Ventures, Logos Fund, American Family Ventures, Meridian Ventures, and angel investors.

This funding marks an important milestone, not only for Pathwork but also for the broader insurance ecosystem, which is in desperate need of modernization.

Redefining the Speed of Insurance

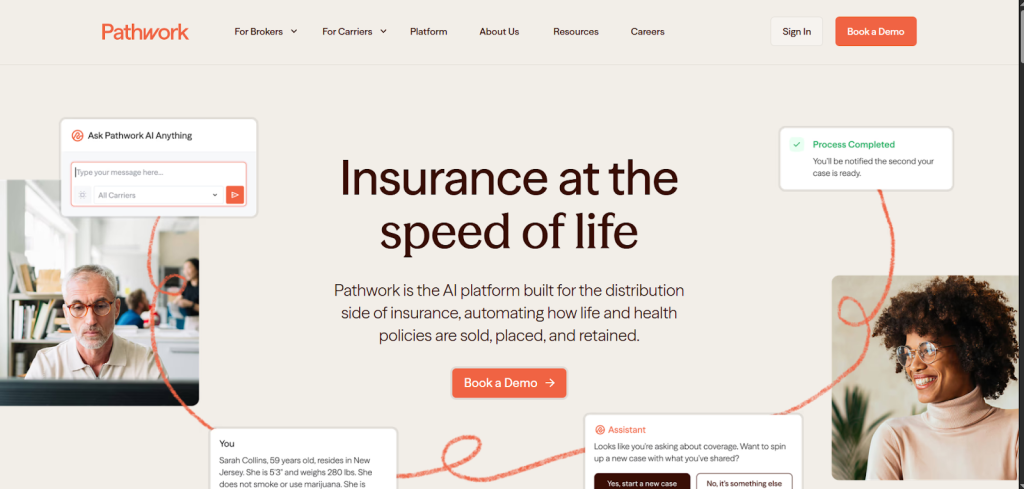

Pathwork positions itself as the AI platform for insurance distribution - a critical part of the value chain where inefficiencies often lead to lost business and frustrated customers. By automating the placement and retention of life and health policies, Pathwork enables brokers, carriers, and clients to experience insurance as it should be: seamless, fast, and reliable.

The platform’s strength lies in leveraging AI to cut through the noise and complexity of traditional insurance processes. Where manual tasks once slowed decisions, Pathwork creates an environment where policies are processed and retained with minimal friction.

The Significance of This Raise

The $3.5 million seed funding is more than just capital. It validates the growing appetite for insurtech solutions that don’t merely digitize existing systems but rethink them entirely. For investors, Pathwork represents a timely opportunity to back a team intent on transforming a sector that accounts for trillions of dollars in annual premiums worldwide.

For Pathwork, this funding provides the resources to expand product development, grow partnerships with carriers and brokers, and extend its AI capabilities to serve more segments of the insurance market.

Building for the Backbone of Insurance

While many insurtech startups focus on customer-facing innovation - like sleek apps or digital-first policy management - Pathwork is going deeper. The company is tackling the distribution backbone of insurance, a layer that determines how effectively policies move through the system.

And this is where a critical insight for founders emerges. Pathwork’s journey highlights the immense opportunity in focusing on unseen but indispensable infrastructure problems. It’s often tempting to build solutions that dazzle end users, but the greatest long-term value comes from solving problems that the industry itself can’t ignore. Distribution inefficiencies may not make headlines, but they cost insurers and brokers billions annually. By addressing this structural pain point, Pathwork has carved out a role that makes it essential, not optional, to the future of insurance operations.

For founders, the ultra-value drop here is clear: investors don’t just fund products that look good - they fund platforms that plug critical leaks in billion-dollar industries. If your startup solves a “hidden bottleneck” that no one else dares to touch, you create defensibility and scale that others will struggle to replicate.

Why Investors Are Betting on Pathwork

The round’s investor mix speaks volumes. Costanoa Ventures has a history of supporting B2B infrastructure startups, while American Family Ventures brings deep domain knowledge in insurance. Meridian Ventures and Logos Fund add strategic capital aimed at scaling growth. With this support, Pathwork not only gains financial backing but also the expertise and industry connections needed to accelerate adoption across carriers and brokers.

A Market Ripe for Disruption

The insurance industry is enormous, yet its digital transformation has lagged behind sectors like banking and payments. Distribution remains fragmented and highly manual, particularly in life and health policies. With AI-driven automation, Pathwork stands at the forefront of solving these inefficiencies at scale.

This positions the company in a sweet spot where market demand, investor capital, and technological readiness converge. As insurers increasingly prioritize efficiency and customer experience, Pathwork’s platform becomes an enabler of modernization across the ecosystem.

Looking Ahead

With its seed round secured, Pathwork is poised to expand rapidly. The team will likely focus on:

- Enhancing AI capabilities to cover more policy types.

- Growing its network of carrier and broker partners.

- Scaling operations to handle larger volumes of distribution activity.

- Building out integrations with existing insurance systems for smoother adoption.

The long-term vision is clear: to become the trusted infrastructure layer powering insurance distribution at scale, enabling brokers and carriers to operate faster, smarter, and with greater efficiency.

Final Thoughts

The $3.5 million seed raise is not just fuel for Pathwork’s growth - it’s a signal of where the industry is heading. By focusing on the backbone of distribution, Pathwork isn’t simply competing with other insurtechs; it’s shaping the future of how policies move across the industry.For the insurance sector, this represents progress. For Pathwork, it’s the beginning of a journey to become the indispensable platform for brokers and carriers worldwide.