Pave Finance Raises $14 Million Seed Round to Automate Wealth Management

September 13, 2025

byFenoms Startup Research

Pave Finance has secured $14 million in seed funding, a major step in its mission to transform portfolio management with automation and personalization. Founded by Pascal Cévaër-Corey, the company is building a platform designed to make wealth management smarter, faster, and more accessible for both financial advisors and their clients.

While investors for this round remain undisclosed, the raise underscores strong confidence in Pave Finance’s vision to bring automation to an industry still reliant on manual workflows and legacy systems.

The Mission of Pave Finance

Wealth management has historically been a labor-intensive process, requiring advisors to spend countless hours rebalancing portfolios, monitoring performance, and updating client allocations. Pave Finance eliminates these inefficiencies by offering a platform that automates personalized portfolio management across all client accounts.

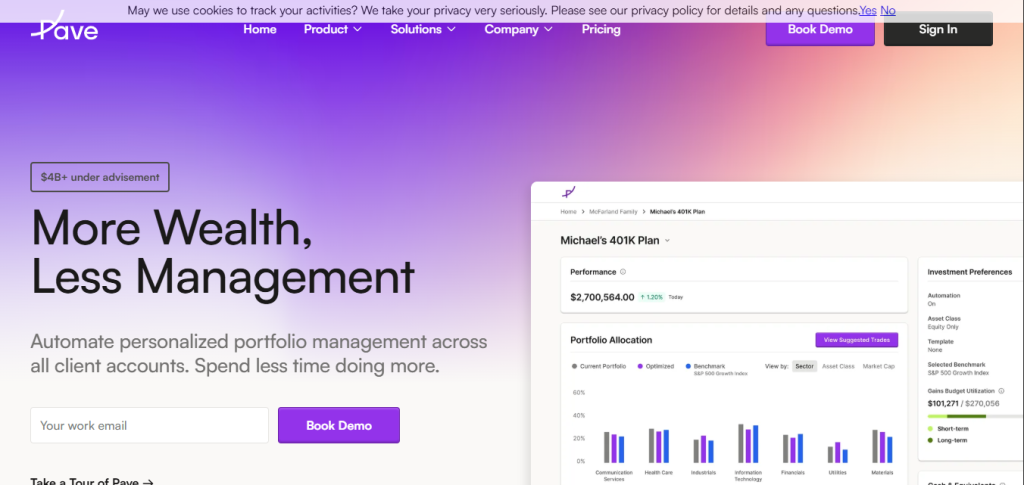

The company’s promise is simple yet powerful: “More Wealth, Less Management.” With Pave, advisors can scale their practices without sacrificing precision, while clients benefit from data-driven, tailored strategies that adapt to changing markets in real time.

This approach not only saves time but also democratizes access to sophisticated wealth management, breaking down barriers that previously kept advanced financial strategies limited to high-net-worth individuals.

Why This Funding Round Matters

Securing $14 million at the seed stage reflects the immense potential of Pave Finance’s solution in the booming fintech and wealthtech sectors.

The wealth management industry is currently worth $137 trillion globally (Boston Consulting Group) and is expected to surpass $230 trillion by 2030. Yet, despite its size, it remains riddled with inefficiencies. A 2023 Deloitte report revealed that over 60% of wealth managers still rely on manual processes for portfolio management and reporting.

Pave Finance’s automation-first approach directly addresses this pain point, offering advisors the ability to scale their assets under management without scaling costs or operational complexity.

What Founders Can Learn

The real lesson from Pave’s rise isn’t just about fintech innovation - it’s about spotting where human expertise is being wasted.

Wealth managers are highly skilled at client relationships, financial planning, and strategy. But too often, their hours are consumed by repetitive, mechanical tasks that software could handle. Pave Finance saw that gap and built the rails to free up advisors’ time for higher-value work.

For founders, the insight is huge: the fastest way to build adoption is to give professionals back their most precious asset - time. If your product eliminates low-leverage tasks and allows experts to focus on high-leverage work, you’re not just selling efficiency - you’re selling growth.

Just as Salesforce gave sales teams back their selling hours and Canva gave designers speed without compromising quality, Pave Finance is giving wealth managers the freedom to scale impact while reducing operational drag.

Why It Matters Now

The timing of Pave’s funding couldn’t be better. The robo-advisory market is booming, projected to hit $4.6 trillion in assets under management by 2027 (Statista). At the same time, younger investors demand personalization - a 2022 Accenture survey found that 67% of Millennials and Gen Z expect financial services to be customized to their goals and values.

Combine this with the rising costs of compliance and advisor shortages across the industry, and the need for automation-first wealth platforms becomes clear.

Pave Finance sits right at this intersection: solving scalability issues for advisors while delivering hyper-personalized, real-time solutions for clients.

Industry Outlook and Market Potential

The outlook for Pave Finance is highly favorable given current market dynamics:

- WealthTech Growth: The global wealthtech market is expected to grow at a CAGR of 14.8% through 2030 (Grand View Research).

- Automation Demand: A PwC study shows that 77% of financial institutions are prioritizing automation investments over the next three years.

- Client Expectations: Capgemini’s 2023 Wealth Report found that 74% of high-net-worth individuals are likely to switch providers if digital capabilities fall short.

- Advisor Efficiency: According to Cerulli Associates, the average financial advisor can manage only 150 client relationships effectively - a ceiling that automation can help break.

These statistics highlight why investors see massive upside in Pave Finance’s model. The company isn’t just chasing efficiency - it’s tapping into one of the fastest-growing fintech verticals of the decade.

What’s Next for Pave Finance

With $14 million secured, Pave Finance is poised to accelerate product development, expand integrations, and grow its customer base. Advisors can expect more sophisticated automation features, enhanced AI-driven insights, and deeper compliance tools.

The company is also likely to explore partnerships with banks, RIAs, and fintech platforms, bringing its automation capabilities to a wider network of financial professionals.

If Pave succeeds, it could redefine wealth management in the same way Stripe redefined payments: by removing friction and making complex processes seamless, scalable, and accessible.