RevenueCat Raises $50M Series C to Scale Subscription Infrastructure for Mobile Apps

July 10, 2025

byFenoms Startup Research

RevenueCat, the market-leading platform for managing in-app subscriptions, has secured $50 million in Series C funding, catapulting the company into a new phase of scale and global expansion. The round was led by Bain Capital Ventures (BCV) with participation from Index Ventures, Y Combinator, Volo Ventures, SaaStr Fund, and Adjacent.

Founded by Jacob Eiting, RevenueCat has become a critical layer of the mobile stack, helping developers handle subscriptions, revenue analytics, and cross-platform billing with just a few lines of code. This raise signals just how vital subscription infrastructure has become in the mobile economy.

Powering the $200B+ Mobile Subscription Economy

With the app economy projected to reach $567 billion in consumer spending by 2030, subscriptions are now the dominant monetization model for mobile developers. However, managing those subscriptions across platforms (iOS, Android, web) is a mess of APIs, receipts, backend logic, and compliance headaches.

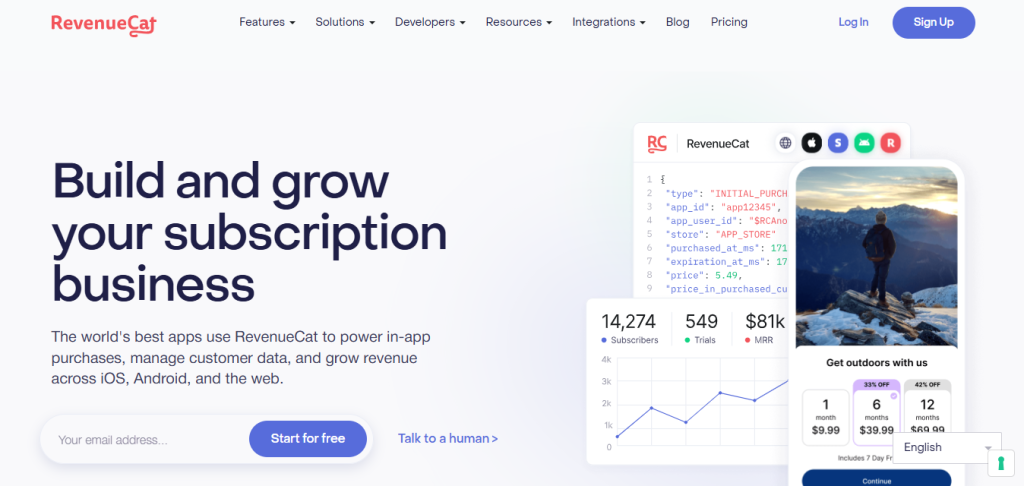

RevenueCat fixes that. It offers a clean, developer-first SDK that abstracts all the complexity of Apple, Google, and Stripe billing systems - making it easy to launch, manage, and grow in-app subscriptions at scale. What Stripe did for payments, RevenueCat is doing for mobile subscriptions.

More than 30,000 apps now run on RevenueCat’s infrastructure, including hits like Notion, Luni, and PhotoRoom. Together, they’ve processed over $2 billion in in-app revenue, giving RevenueCat not just scale, but deep insight into subscription trends across platforms and categories.

Why This Funding Matters Now

The timing of this raise couldn’t be more strategic. Apple and Google have made it clear that subscription monetization is here to stay - but they’ve done little to improve the tools for developers to manage it.

Even large companies struggle with things like receipt validation, subscriber lifecycle events, cancellations, grace periods, refunds, pricing experimentation, and revenue attribution. For smaller dev teams, it’s nearly impossible to build and maintain this infrastructure in-house.

This is where the deeper shift is happening - growth and billing are no longer separate functions. The real ceiling for most mobile SaaS products isn’t in user acquisition - it’s in how they monetize, retain, and optimize their paying users. And that depends on how fast they can test, adjust, and understand their subscription mechanics.

Here’s where most founders miss the mark: building a product that works isn’t enough - what unlocks scale is building a billing system that learns. RevenueCat makes your monetization stack dynamic. It allows you to push pricing updates, A/B test paywalls, segment cohorts, and measure LTV - all without redeploying code or rewriting backends. That agility translates directly into compounding growth.

For early-stage teams especially, this means turning billing from a bottleneck into a growth lever. If you can experiment with pricing as quickly as you ship features, you're operating on a fundamentally different trajectory than your competitors.

Jacob Eiting and the Team Behind the Vision

CEO and co-founder Jacob Eiting started RevenueCat after experiencing the pains of in-app subscription development firsthand as an engineer at Elevate Labs. Alongside co-founder Miguel Carranza, he built RevenueCat with a simple thesis: developers should never have to touch subscription receipts again.

What started as a simple wrapper for Apple’s StoreKit API is now a fully-fledged subscription lifecycle engine. The team has grown rapidly, maintaining a strong focus on developer experience, clean API design, and scalability. With this funding, RevenueCat will expand its 70+ person team and invest deeply into R&D, customer support, and community engagement.

Market Outlook: Subscription Infrastructure Is Mission Critical

The mobile app economy is shifting from acquisition-led to retention-led growth. Subscriptions are no longer just a pricing model - they are a product design and analytics challenge. According to Adjust, 79% of total app store revenue now comes from subscription-based apps - yet most developers are still hacking together brittle billing logic.

Additionally, a Sensor Tower report found that consumer spending on non-game subscription apps reached $18.3 billion globally in 2023, up from $13.4 billion in 2022 - a 36.5% YoY increase. As the macro shift toward digital subscription services accelerates, so does the complexity of managing churn, trials, and upgrade paths.

RevenueCat is strategically positioned to capture this surge by offering the infrastructure layer many developers lack. With the rise of cross-platform tools like Flutter and React Native, developers need solutions that abstract away platform-specific billing headaches - and RevenueCat delivers just that.

Moreover, new regulatory pressures - such as the Digital Markets Act in the EU and ongoing antitrust scrutiny in the U.S. - are further fragmenting app store billing rules. RevenueCat acts as a protective layer, giving developers flexibility to stay compliant while preserving growth velocity.

What’s Next for RevenueCat?

With this fresh $50 million in capital, RevenueCat plans to expand its data capabilities, invest in machine-learning-based churn prediction, and build more powerful tools for paywall optimization and real-time subscriber analytics.

Additionally, there's strong momentum toward enterprise-level offerings, positioning RevenueCat not just as a tool for indie devs, but as the subscription engine of choice for scale-ups and unicorns in mobile SaaS.

This round sets the stage for deeper integrations with analytics platforms like Amplitude, Segment, and Mixpanel, as well as experimentation tools like Firebase and Optimizely - further embedding RevenueCat into the modern mobile growth stack.