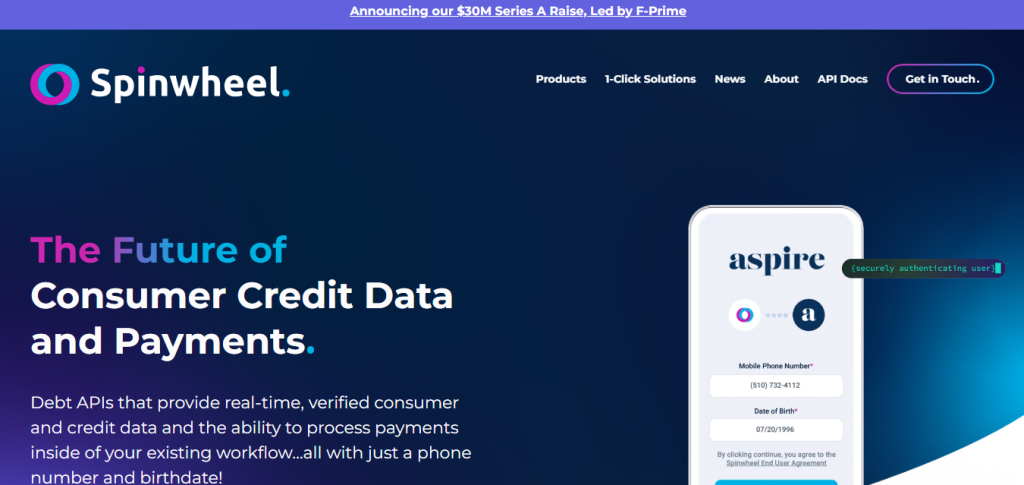

Spinwheel Secures $30M Series A to Redefine Consumer Credit Data and Payments

July 10, 2025

byFenoms Startup Research

Spinwheel, a rising force in the fintech sector, has successfully closed a $30 million Series A funding round led by F-Prime, with participation from QED Investors, Foundation Capital, and Fika Ventures. This significant capital injection underscores growing investor confidence in Spinwheel’s vision of transforming how businesses access and utilize consumer credit data and streamline payment processing through its debt-focused API platform.

Founded by Tomás Campos, Spinwheel is positioning itself as a critical layer in the infrastructure stack of modern financial platforms, delivering tools that enable real-time credit insights, payment integrations, and workflow automation - all from just a phone number and a birthdate.

What Spinwheel Does

Spinwheel provides developers with APIs that empower fintechs, banks, and platforms to access, interpret, and act on consumer debt data in real time. The core product offerings include:

- Debt Data APIs: Real-time visibility into loans, balances, APRs, and payment schedules.

- Embedded Payments: Automate payoff and repayment capabilities directly within customer flows.

- Smart Workflows: Trigger actions based on credit changes—such as refinancing, payoff timing, or automated scheduling.

With just a few lines of code, clients can embed Spinwheel’s solutions directly into apps, offering borrowers a transparent and streamlined user experience while improving lender workflows and efficiency.

Why This Matters Now

In today’s financial climate, managing consumer credit isn’t just a backend task - it’s a front-line growth opportunity. With inflation pressures, shifting lending regulations, and rising debt loads, more fintech apps are being judged not by their interfaces, but by how meaningfully they reduce friction in financial decision-making.

In the next wave of fintech, the companies that succeed won't just be the ones who offer access to financial data - they’ll be the ones who contextualize it for user action. It’s not about aggregation anymore. It’s about activation. Spinwheel’s edge lies in its ability to turn static credit information into dynamic workflows that power better decision-making - whether it's accelerating loan approvals, automating debt management, or simplifying buy-now-pay-later integrations.

If you're building in fintech today, think about your user’s pain points not just in terms of access, but in terms of momentum. How fast can they act on the data you give them? How embedded is your product in their existing financial behavior? That’s the wedge Spinwheel is exploiting - and it's a model others will follow. Fintech Trends and Market Outlook

The timing for Spinwheel’s growth is ideal. According to a recent report by CB Insights, global fintech funding reached $34.9 billion in Q1 2024, signaling a recovery in investor confidence. Within that, embedded finance and API-first infrastructure companies are among the fastest-growing sub-segments, as B2B platforms seek to build deeper financial functionality into their core products.

Additionally, U.S. household debt hit a record $17.69 trillion in early 2024, per the Federal Reserve Bank of New York - driven by increases in credit card balances, student loans, and auto loans. This surge has created an urgent need for platforms that offer more visibility and control over personal finances, especially for Gen Z and Millennial consumers who favor mobile-first financial tools.

Spinwheel’s focus on real-time debt APIs fits squarely into this growing demand for smart credit infrastructure. As more apps seek to integrate intelligent payment management and debt visibility features, Spinwheel positions itself as the enabling layer that can make those use cases not just possible - but scalable.

What’s Next for Spinwheel

With its fresh capital, Spinwheel plans to accelerate product development, scale its sales and partnerships teams, and deepen integrations with fintech platforms, lenders, and financial wellness applications. The company is also focused on expanding the capabilities of its API suite, enabling more nuanced and predictive credit tools that can support consumers before debt becomes overwhelming.

As financial APIs move from optional enhancements to essential infrastructure, Spinwheel’s momentum offers a valuable case study in where the fintech sector is headed - and what it takes to build a product that not only accesses data, but activates it for good.

Who’s Backing Spinwheel

The company’s new funding round was led by F-Prime Capital, a prolific investor in foundational fintech infrastructure, alongside QED Investors, known for backing firms like Credit Karma, Nubank, and SoFi. Foundation Capital and Fika Ventures also returned for this round, reaffirming their early belief in Spinwheel’s roadmap.

This backing isn't just financial - it validates the growing demand for fintech tools that move beyond PFM (Personal Finance Management) and into core infrastructure. Spinwheel’s solution addresses one of the most painful, underserved parts of consumer finance: managing debt across providers and payment systems.

The Market Outlook for Credit APIs and DebtTech

The Credit API and embedded finance space is undergoing rapid expansion. According to McKinsey’s Global Payments Report, embedded finance could reach $7 trillion in transaction volume by 2030, with credit-related products comprising a growing portion of that market. Meanwhile, consumer debt levels in the U.S. are at record highs, including $1.6 trillion in student loans and $1.1 trillion in credit card debt.

Fintechs are increasingly seeking flexible, developer-friendly tools to create unique lending, payoff, or budgeting experiences - driving demand for platforms like Spinwheel. The combination of real-time visibility, actionable data, and frictionless payments has become the holy grail in this niche.

What’s Next for Spinwheel

With the fresh capital, Spinwheel plans to expand its product offerings, grow its engineering and compliance teams, and deepen integrations with financial institutions and apps. There’s also a strong push to enhance fraud detection, repayment intelligence, and cross-lender data normalization - all mission-critical as regulation in fintech continues to evolve.

Spinwheel is now racing ahead to become the dominant infrastructure layer in the emerging “DebtTech” landscape - an area with massive potential but very few established players.