Still Bright Raises $18.7M to Reinvent Copper Extraction for the Energy Transition

August 6, 2025

byFenoms Startup Research

Still Bright, a climate-tech innovator focused on clean copper extraction, has secured $18.7 million in seed funding to scale its modular, eco-friendly platform. Backed by leading investors including Material Impact, Breakthrough Energy, Azolla Ventures, Fortescue, Impact Science Ventures, and SOSV, the company aims to eliminate the environmental harm of traditional copper mining while meeting the soaring global demand for this critical metal.

Co-founded by Ranulfo (Randy) Allen, PhD, and Jon Vardner, Still Bright is deploying a radically different approach to copper recovery - one that’s decentralized, waste-focused, and aligned with net-zero goals. Rather than gouging out new mines, Still Bright taps into tailings, waste streams, and low-grade ores, extracting copper with precision chemistry and minimal environmental disruption.

Solving Copper’s Critical Bottleneck

Copper is indispensable to the electrification era. As of 2024, global refined copper production stood at approximately 22.9 million metric tons. Yet demand is rapidly outpacing supply: projections estimate copper usage could double to over 40 million tons by 2040. BHP forecasts a 70% increase in demand by 2050 due to EVs, renewables, AI data centers, and grid expansion.

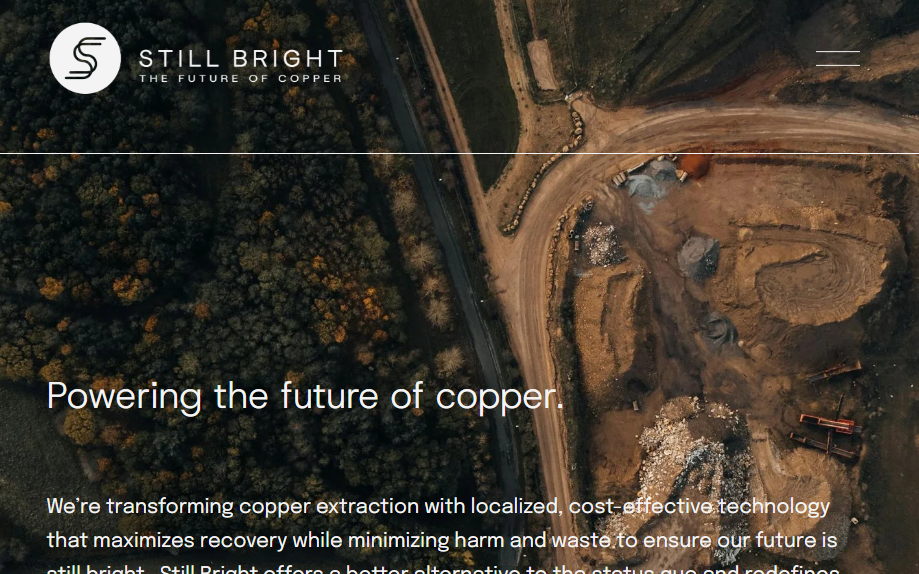

Traditional mining—dominated by open-pit operations—is increasingly unsustainable. It generates over 100 million tons of tailings annually, while ore grades decline, and emissions rise. By contrast, Still Bright's technology extracts copper directly from tailings and waste streams, minimizing land disturbance and capital-intensive infrastructure.

Reimagining Copper for a Net-Zero Future

Copper sits at the core of the green transition. Every electric vehicle, wind turbine, solar panel, and battery depends on it. Yet conventional copper mining is fundamentally broken. Open-pit mines account for 70% of production, but they come at a cost: deforestation, water depletion, toxic waste, and high energy input. Meanwhile, ore grades are plummeting - today’s mines must process more rock for less copper.

Still Bright flips this model on its head. By recovering copper from material previously deemed "waste," the company is creating a circular, scalable, and community-friendly solution.

The genius of Still Bright isn’t just technical - it’s in rethinking the entire go-to-market model for industrial tech. Instead of waiting for large, centralized infrastructure deals to fall into place, they’re making modular, field-deployable systems that slot into existing operations. This means they can start small, show ROI fast, and scale through partnerships instead of permits.

For founders building in deeptech or hard-to-scale sectors: design your tech for edge deployment, not just central rollout. Decentralization isn’t just a hardware decision - it’s a business strategy that unlocks speed, flexibility, and resilience in tough regulatory or capital-intensive markets.

Investors Back the Vision

This seed round is a major vote of confidence from top-tier backers:

- Material Impact brings expertise in scaling science-based ventures

- Breakthrough Energy, founded by Bill Gates, focuses on climate-critical innovation

- Azolla Ventures, Fortescue, Impact Science Ventures, and SOSV add further technical, global, and sustainability-oriented credibility

Their investment signals that Still Bright isn’t just a novel idea - it’s a real contender in the race to decarbonize the materials sector.

Copper Demand Is Booming - But Supply Chains Are Strained

The urgency is real. According to S&P Global, the world faces a 6.5 million metric ton copper shortfall by 2035. The International Energy Agency (IEA) predicts copper demand will double by 2040, driven by electrification.

And yet:

- Ore grades have declined by 25% in the past two decades

- Traditional extraction methods emit more than 3 tons of CO₂ per ton of copper produced

- Over 100 million tons of tailings are produced annually - an untapped $30B copper opportunity

Still Bright isn’t just solving for sustainability - it’s solving for scalability, security, and cost.

What’s Next for Still Bright

The $18.7 million injection will be used to:

- Pilot systems at mine sites and with global copper customers

- Grow the technical team to refine chemistry and scale hardware

- Form strategic partnerships with mining companies and renewable infrastructure players

- Accelerate commercialization of modular units across North America

The company envisions a future where copper production is no longer a dirty secret - but a clean, distributed system that aligns with the climate goals it supports.

As Vardner puts it, “If clean energy is the future, clean materials must be the present.”