Telcoin Raises $25M Pre-Series A to Build a Regulated “Internet of Money”

October 18, 2025

byFenoms Startup Research

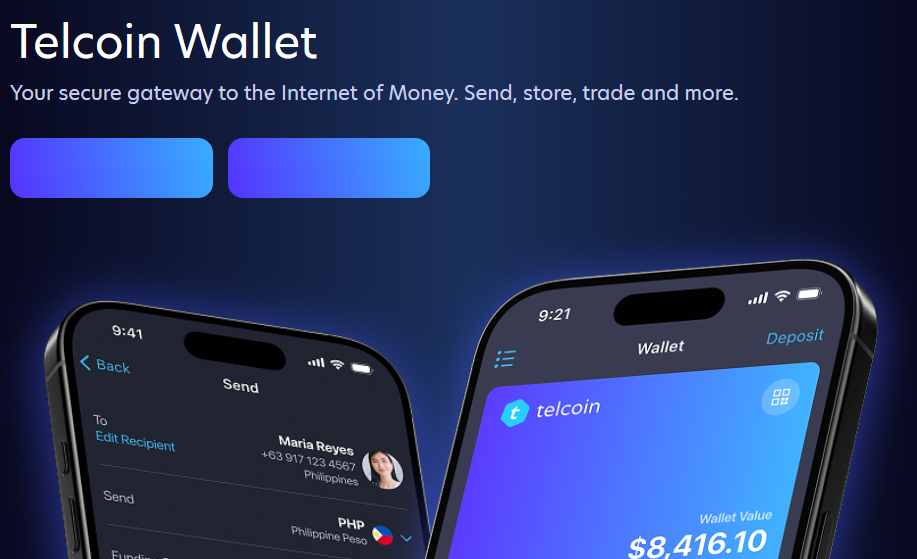

Telcoin, a blockchain-telecom fintech startup, has locked in $25 million in Pre-Series A funding from investors including Tom Kaiman and Matt Maser to power its regulated banking and stable coin ambitions. Telcoin’s roadmap includes launching Telcoin Bank under a Nebraska charter, issuing eUSD, and integrating blockchain rails with telecom infrastructure across emerging markets.

Telcoin already operates remittance corridors to 20+ countries, charging around 2% or less on certain transfers - a fraction of traditional cross-border fees. It describes its mission as uniting telecom, digital banking, and blockchain to build the “Internet of Money.”

Why This Ambitious Stack Matters

Remittances remain a massive, costly global flow. The World Bank estimates that migrants send $700+ billion annually in personal remittances to low- and middle-income countries. Traditional remittance services often charge 5–8% and take days to settle - friction that Telcoin aims to remove using crypto rails + telecom reach.

Adding to that, the stablecoin + regulated bank layer is a bold differentiator. Telcoin’s Nebraska Digital Asset Depository Institution (DADI) charter is intended to allow it to connect DeFi and regulated finance under one roof - a rare hybrid approach in crypto.

The Founders’ Play at the Intersection of Trust & Innovation

Many crypto and fintech startups race to push the envelope - faster, cheaper, more decentralized. But Telcoin’s insight lies deeper: innovation often wins when paired with permissioned trust.

Telcoin isn't just building a new rail; it’s anchoring it in regulation and institutional credibility. When it issues eUSD under a charter and supports DeFi connectivity legally, it’s not competing on just speed - it’s competing on certainty.

In fintech and crypto, your biggest moat isn’t your protocol - it’s your permission.

If you build a system that regulators, institutions, and users trust - not just a fast one - you shift from being experimental to infrastructure. Telcoin’s regulated architecture puts it in a position where its permission isn’t a weakness, it’s a differentiator.

Once users feel safe using your system - even across regulatory regimes - it becomes harder to dislodge you. Many founders build the fastest products. Few also build the trustworthy ones.

Roadmap, Challenges & Strategic Risks

With the new capital infusion, Telcoin plans to:

- Launch Telcoin Bank under its DADI charter

- Mint and manage eUSD

- Deepen telecom & mobile operator partnerships for on- and off-ramp access

- Expand remittance lanes and user reach

- Build DeFi interoperability modules under compliant frameworks

Yet the road ahead is thick with challenges:

- Regulatory risk: Navigating stablecoin laws, banking oversight, and telecom regulation is complex.

- Trust & adoption: Gaining everyday users’ and institutions’ trust in eUSD and new rails is not automatic.

- Operational security: Running a regulated blockchain bank invites scrutiny, audits, and zero tolerance for failure.

- Cost & scale: Maintaining secure, compliant rails while keeping transaction costs low is a delicate balance.

Telcoin’s hybrid approach - blending regulated finance with crypto innovation - gives it optionality. If the crypto world shifts, it can lean into its regulated bank. If DeFi grows, it can become a bridge between systems.

Why This Raise Matters

Telcoin’s $25M raise is a signal that the crypto world’s next frontier isn’t about chaos - it's about permissioned innovation. The future rails won’t just be faster - they’ll be trusted.

For founders in fintech or blockchain: it’s not enough to build the fastest system. The ones that last will be those built with the bridge between regulation + innovation, speed + certainty, crypto + institutionality.

Telcoin isn’t just inventing remittance rails. It’s inventing rails we’re allowed to use. And that’s where long-term defensibility lies.